Long-living payments

The Long-living payments feature is enabled on case-by-case basis. To enable Long-living payment requests, please contact your key account manager or partner manager. For more information, see Legal terms.

Set up payments with extended validity periods and configurable expiration times for scenarios requiring longer payment windows.

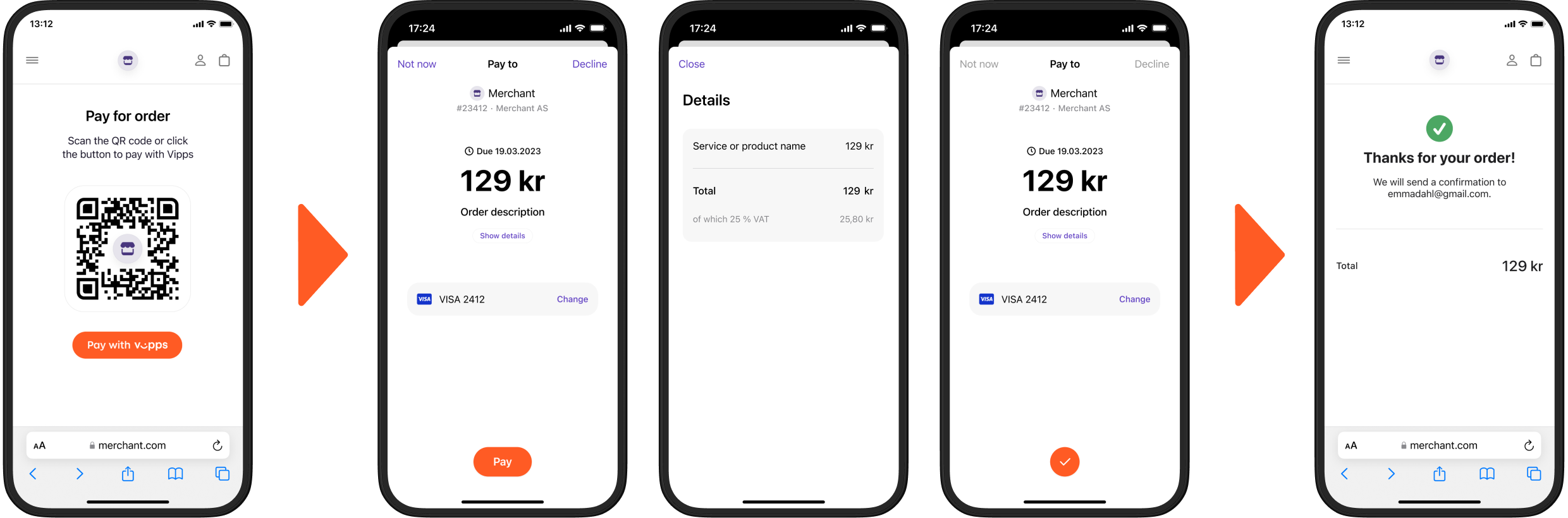

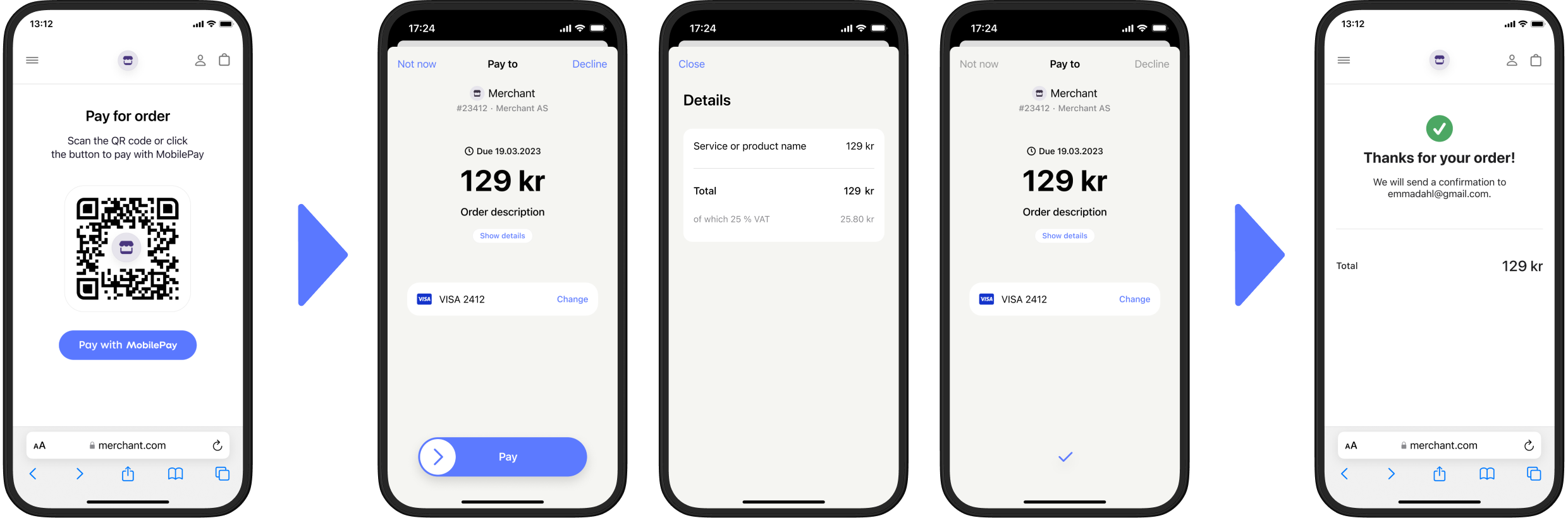

User flow

If you have the customer's phone number and their consent to send payment requests through Vipps MobilePay, you can send payment requests directly to their app.

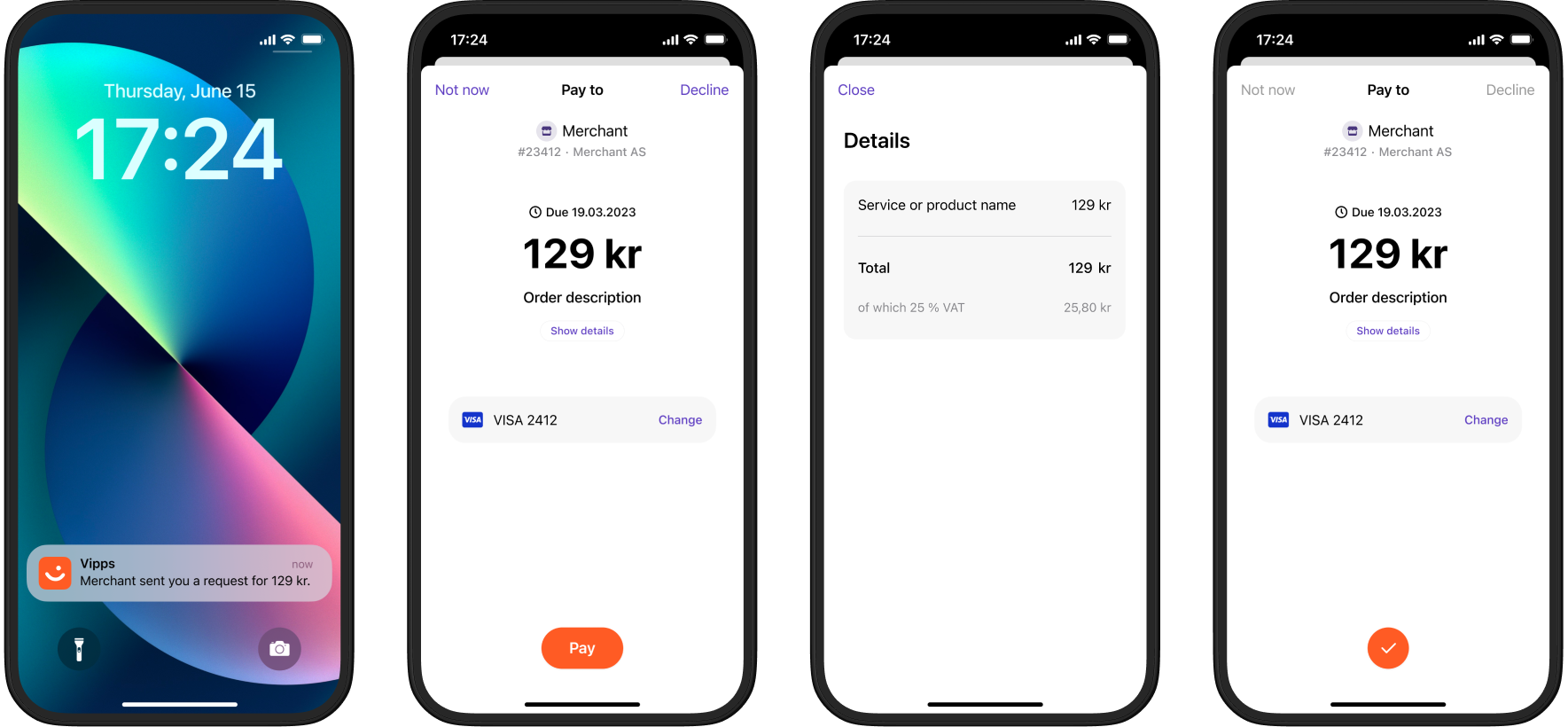

- Vipps

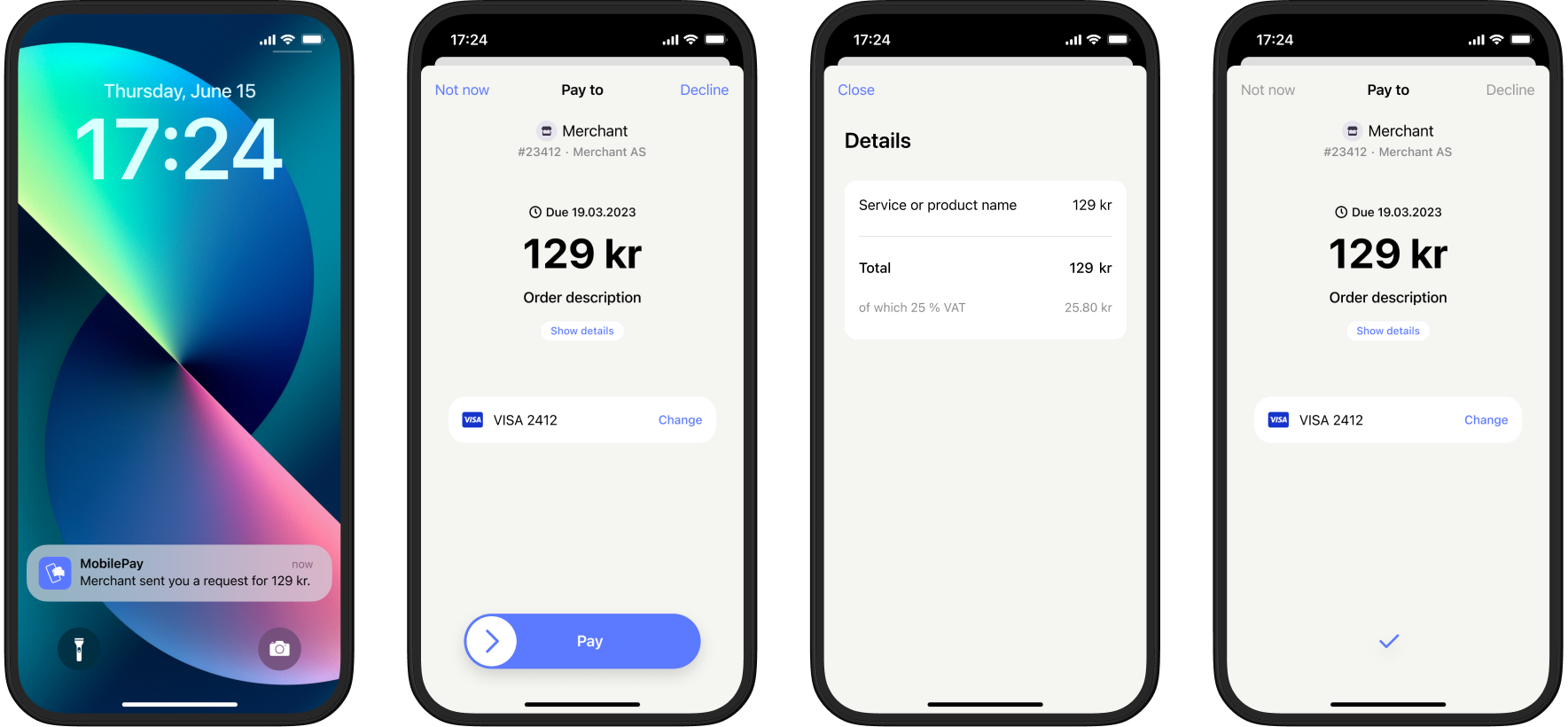

- MobilePay

- Since you have the customer's phone number, send the create payment request where

customer.phoneNumberis set. - The customer will receive a push notification in their Vipps

or MobilePay

or MobilePay  app.

app. - When the customer selects

Show detailsin the payment confirmation screen, they are presented with the order information provided by the merchant without leaving the Vipps or MobilePay app. - The customer approves, rejects, or postpones the payment.

- The user will be able to retrieve the order details in the app under Activities.

Creating a long-living payment

Specify expiresAt in the create payment request.

The expiresAt must be between 10 minutes and 60 days in the future, or within the maximum extension limit established for your sales unit (see Legal terms).

Payment initiation:

To initiate a long-living payment, call the create payment endpoint,

POST:/epayment/v1/payments, with expiresAt set

to a date according to RFC 3339 format.

Note, if you try to use this with a sales unit that is not enabled for it, you will get an error.

Specify the customer's phone number or generate a QR they can scan to start the payment.

Payment with customer phone number

To initiate a long-living payment with the customer's phone number:

curl -X POST https://apitest.vipps.no/epayment/v1/payments \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR-ACCESS-TOKEN" \

-H "Ocp-Apim-Subscription-Key: YOUR-SUBSCRIPTION-KEY" \

-H "Merchant-Serial-Number: YOUR-MSN" \

-H 'Idempotency-Key: YOUR-IDEMPOTENCY-KEY' \

-H "Vipps-System-Name: acme" \

-H "Vipps-System-Version: 3.1.2" \

-H "Vipps-System-Plugin-Name: acme-webshop" \

-H "Vipps-System-Plugin-Version: 4.5.6" \

-d '{

"expiresAt":"2026-01-15T23:59:59+02:00",

"userFlow":"PUSH_MESSAGE"

"paymentDescription": "Invoice# 424243, due date: 15 January 2026",

"paymentMethod":{

"type":"WALLET"

},

"receipt":{

"orderLines": [

{

"name": "Service or product name",

"productUrl": "https://example.com/link/to/product",

"id": "line_item_1",

"totalAmount": 12900,

"totalAmountExcludingTax": 10320,

"totalTaxAmount": 2580,

"taxRate": 2500

}

],

"bottomLine": {

"currency": "DKK",

"receiptNumber": "20260115-00123"

}

},

"amount":{

"currency":"DKK",

"value":12900

},

"customer":{

"phoneNumber": CUSTOMER-PHONE-NUMBER

},

"reference":"acme-shop-123-order123abc",

}'

When this request is submitted, a push message will be sent to the customer's app (specified with phoneNumber).

They can see the details of the payment from within their Vipps  or MobilePay

or MobilePay  app.

Note that they can also find the order details in the app later on, under Activities.

app.

Note that they can also find the order details in the app later on, under Activities.

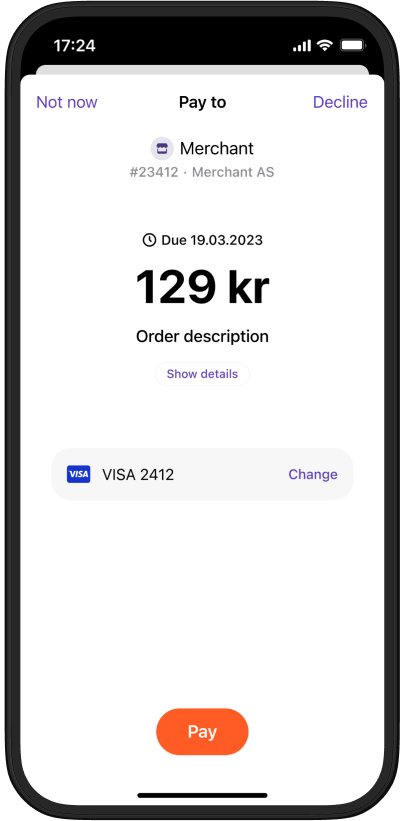

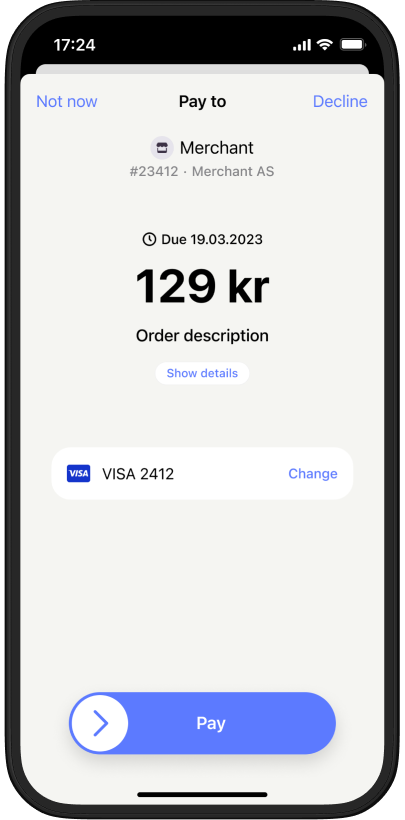

The customer will select from these options:

- Pay - Pay immediately

- Not now - Pay later

- Decline - Reject the payment

- Vipps

- MobilePay

Payment with QR

To initiate a long-living payment that generates a QR code, modify the

example above by

setting "userFlow":"QR" and removing the customer property.

When this request is sent, a link to a QR will be generated. You can provide the QR to them, and they can scan it when they are ready to make the payment.

When they scan the QR:

- If MobilePay is installed, it will automatically open and present the payment.

- If it's not installed, the landing page will open. They will enter their phone number and can continue in their MobilePay app.

- Vipps

- MobilePay

If you want to get the user's phone number as part of this process, you can request that they share their profile information. This would introduce an extra page where they give consent.

Customer reminders

Order details

The customer can see the details of the payment from within their Vipps  or MobilePay

or MobilePay  app

before they approve, delay, or decline the payment.

app

before they approve, delay, or decline the payment.

These are also available later, in the Vipps or MobilePay app, under Activities.

Properties related to long-living payments

When setting the expiresAt property, it is a requirement to provide information about the products being sold.

This data can be used for

Content monitoring.

In Norway, it is mandatory to supply the payment details through receipt.orderLines with productUrl.

In Denmark and Finland, it is recommended to supply the payment details through either receiptUrl or receipt.orderLines with productUrl.

To create a payment request with long-living expiry date, use the

POST:/epayment/v1/payments

with the following properties:

paymentMethod.type- The payment method type must beWALLET. This functionality is only available when using theWALLETpayment method, since the app is required (it does not work with freestanding card payments).reference- The ID of the payment request.expiresAt- The expiration date for the payment in RFC 3339 format. This is what separates the long-living payment request from a regular payment.userFlow-WEB_REDIRECT,PUSH_MESSAGE,QR,NATIVE_REDIRECT. See user flows for details.paymentDescription- Short description with relevant information about the payment request. This is shown on the payment screen in the app.receipt.orderLines- Order details for the payment. Note that in Norway, you must specifyreceipt.orderLineswithreceipt.orderLines.productUrl. Theorderlinesare the same as referenced in the Order Management API. This must be present.receiptUrl- In Denmark and Finland, it is allowed to send this URL instead ofreceipt.orderLines.customer.phoneNumber- The customer's phone number. This is optional, and will be used if the users phone number is known in advance.scope- This can be used to request the user to share their telephone number.

Troubleshooting

"ExpiresAt not allowed"

Sales units (i.e., Merchant Serial Numbers) must be especially approved to use this feature. The user experience, including the standard timeout, should be as consistent as possible, so this should only be used in special cases. To request this feature, please contact your key account manager, your partner manager, or customer service.

Sequence diagram

Integration sequence for the standard payment flow, where payment request is sent directly to app.

Standard payment flow

Legal terms

Long-living payment requests are enabled by Vipps MobilePay on case by case basis to Merchants and sales units that fulfil the requirements set forth by Vipps MobilePay from time to time.

To enable Long-living payment requests, please contact your key account manager or partner manager.

General requirements

The ePayment API enables setting the timeout for a payment in certain circumstances. The timeout can range from 10 minutes to the maximum allowable timeout for your sales unit, which can be up to 60 days. However, to secure a consistent user experience we advise avoiding longer than 10-minute timeouts unless they are necessary for a special use case.

For avoidance of doubt, Vipps MobilePay is not responsible if the customer doesn’t approve the payment request. Merchant will remain responsible for monitoring the status of the payment and collecting any outstanding payments.

Specific requirements for Norwegian Merchants

- Timeout can not exceed 24 hours.

- The customer must be present at the time the service is performed and/or agreed upon.

- The customer must be informed of and agree to Merchant’s terms of sale, including relevant information on payment methods and applicable charges. Vipps MobilePay may require the Merchant to verify the customer’s acceptance.

- The Merchant may send the payment request only after the delivery of the product or service.

- The Merchant must add purchase order lines in the payment request.