Vipps PSP API guide

Applicable to Vipps.

Applicable to Vipps.

API version: 3.0

The PSP API provides tokens that a Payment Service Provider (PSP) can use to charge a Vipps user's card. Essentially, it functions as a "card token lookup service." The PSP finalizes the payment and then informs Vipps of the transaction's success or failure.

Process overview

When a customer wants to pay with Vipps, they only need to provide their phone number. Then you, as the PSP, initiate a payment request through the PSP API.

The user simply enters their Norwegian mobile number and approves the payment in their Vipps app.

In the Vipps app, the user can select the payment card they wish to use for the purchase. Vipps then gives the PSP a token for that card, so they can process the payment.

The PSP processes the payment using the card token received from Vipps, and the PSP informs Vipps about the status of the payment.

Settlements for PSP integrations are handled by the PSP, but you can use the PSP API to initiate PSP payments.

The following user flow provides illustrations: Payments online

Prerequisites

Payment tokenisation

All PSPs must be able to process network tokens. See the EMV® Payment Tokenisation for more information.

Service endpoint

Once the Vipps user has confirmed the payment in the Vipps app, Vipps shares the network token with you by posting to the service endpoint you provide.

For details, see:

PSP API implementation checklist

See: PSP API Checklist.

PSP payment sequence

The following diagram illustrates the PSP payment sequence in detail:

Important: Some users may close Vipps immediately after seeing the payment confirmation

screen in the app, therefore not being "redirected" back to the merchant. Because of this,

it is important for the merchant and the PSP to not base their transaction logic on the

user reaching the pspRedirectUrl.

For example: Check for "reserved" status with the PSP's API (not Vipps' API), then do "capture" when the goods have been shipped/delivered. See capture regulations.

Please note: Vipps does not have more information about the payment than what the PSP has sent. See the FAQ: How can I get details for a payment?

Payment operations

All Vipps API calls are authenticated with an access token and an API subscription key. Details are found under: Request an access token.

We recommend using the standard Vipps HTTP headers for all requests.

See HTTP headers in the Knowledge base, for details.

Initiate payment

When a user chooses Vipps as the payment method, a payment request is initiated by the PSP to the Vipps API. Vipps creates the payment and returns a link that does the following:

- For users on a mobile device, the Vipps app is opened.

- For other users, the Vipps landing page is opened in a browser. The user can then enter their phone number and continue in the Vipps app on their phone.

The user then confirms the payment in Vipps.

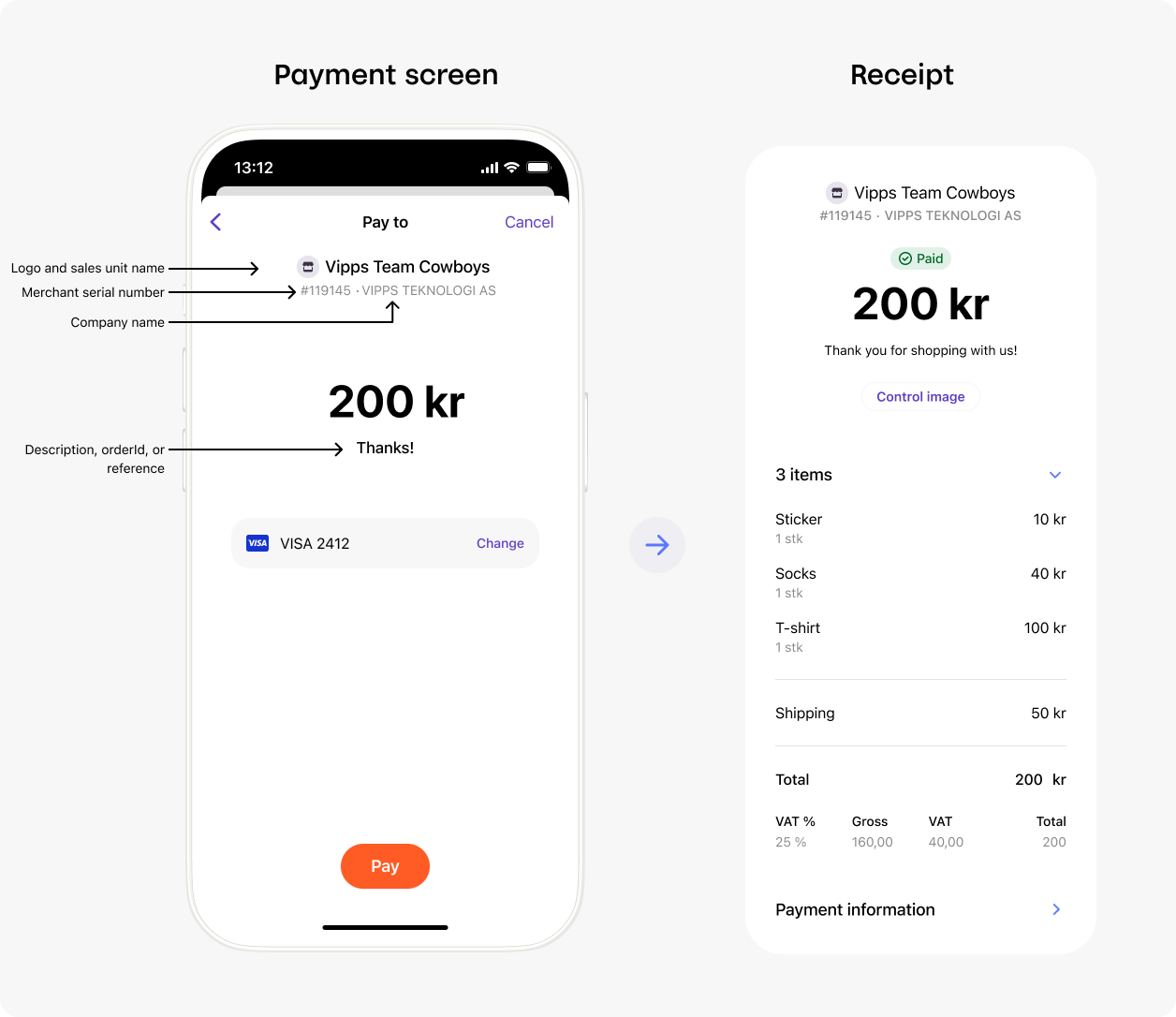

- Merchant (sales unit) name - The name of the store, app, or service.

- Company name - The legal name of the business.

- Merchant Serial Number - Identifier for the merchant (sales unit).

- Payment Description, reference, or Order ID -

The description or the

orderIdassociated with this purchase, as provided by the merchant.

Initiate a payment with:

POST:/psp/v3/psppayments/init/. For example:

curl -X POST 'https://apitest.vipps.no/psp/v3/psppayments/init' \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR-ACCESS-TOKEN" \

-H 'Ocp-Apim-Subscription-Key: YOUR-PSP-SUBSCRIPTION-KEY <keep this secret>' \

-H 'PSP-ID: <Provided by Vipps>' \

-H 'Merchant-Serial-Number: YOUR-MSN' \

-H 'Vipps-System-Name: acme' \

-H 'Vipps-System-Version: 3.1.2' \

-d '{

"pspTransactionId": "7686f7788898767977",

"merchantOrderId": "abcABC-12345",

"amount": "49900",

"currency": "NOK",

"pspRedirectUrl": "https://example.com",

"makePaymentUrl": "https://callback.psp.com/cardCallback/7686f7788898767977",

"makePaymentToken": "abcABC-12345",

"paymentText": "Pair of socks",

"isApp": false,

"skipLandingPage": false,

"minimumUserAge": 25

}'

Example response:

{

"errorMessage": {

"errorId": 82,

"errorText": "Refused by Issuer"

},

"paymentInfo": {

"pspTransactionId": "7686f7788898767977",

"status": "FAIL"

}

}

If the request is not valid, errors will be returned.

A push notification will be presented in the Vipps app on the user's phone. When the user approves the payment, Vipps automatically reserves the payment and provides confirmation of the successful payment.

The user should be redirected back to the specified pspRedirectUrl URL under a "best effort" policy.

On that page, show the order confirmation.

We cannot guarantee that the user will be redirected back to the same browser or session, or that they will at all be redirected back. User interaction can be unpredictable, and the user may choose to fully close the app or browser.

Receive the user's card token

When the payment is confirmed in the Vipps app,

Vipps will share the user's card token with you by posting to the

POST:makePaymentUrl.

Vipps requires a HTTP 200 OK response and a response body with

"paymentInfo.status": "OK"

for the POST request to the makePaymentUrl.

Vipps then sets the payment's status to RESERVED.

If we don't receive the expected response, the payment's status will be FAILED.

Process the payment

This step is done by you, the PSP, using the card token.

After receiving the card data, you can use the card token to process the payment through the acquirer.

Vipps is not involved in the actual payment, Vipps only provides the PSP with the card token.

Update the status of the payment

Update the status of the payment by sending the

POST:/psp/v3/psppayments/updatestatus request.

For example:

curl -X POST https://apitest.vipps.no/psp/v3/psppayments/updateStatus \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR-ACCESS-TOKEN" \

-H "Ocp-Apim-Subscription-Key: YOUR-SUBSCRIPTION-KEY" \

-H 'PSP-ID: <Provided by Vipps>' \

-H "Vipps-System-Name: acme" \

-H "Vipps-System-Version: 3.1.2" \

-d '{

"transactions": [

{

"pspTransactionId": "abcABC12345",

"status": "CAPTURED",

"amount": "49900",

"currency": "NOK",

"paymentText": "Transaction updated"

}

]

}'

When updating the status it's important to use the correct pspTransactionId.

Our endpoint only does basic input validation, and the response is HTTP 200 OK as long as the request is correctly formatted.

The payment is updated asynchronously.

If the pspTransactionId is incorrect, the status of the payment will not be updated.

Get the payment details

To see the details about a transaction, send the

GET:/psp/v3/psppayments/{pspTransactionId}/details

request.

curl -X GET https://apitest.vipps.no/psp/v3/psppayments/{pspTransactionId}/details \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR-ACCESS-TOKEN" \

-H "Ocp-Apim-Subscription-Key: YOUR-SUBSCRIPTION-KEY" \

-H 'Idempotency-Key: YOUR-IDEMPOTENCY-KEY' \

-H 'PSP-ID: <Provided by Vipps>' \

-H "Vipps-System-Name: acme" \

-H "Vipps-System-Version: 3.1.2" \

Example response:

{

"pspTransactionId": "abcABC12345",

"merchantOrderId": "abcABC-12345",

"transactionSummary": {

"capturedAmount": 49900,

"remainingAmountToCapture": 0,

"refundedAmount": 0,

"remainingAmountToRefund": 49900

},

"transactionLogHistory": [

{}

]

}

API details

Details about initiating the payment

Vipps landing page

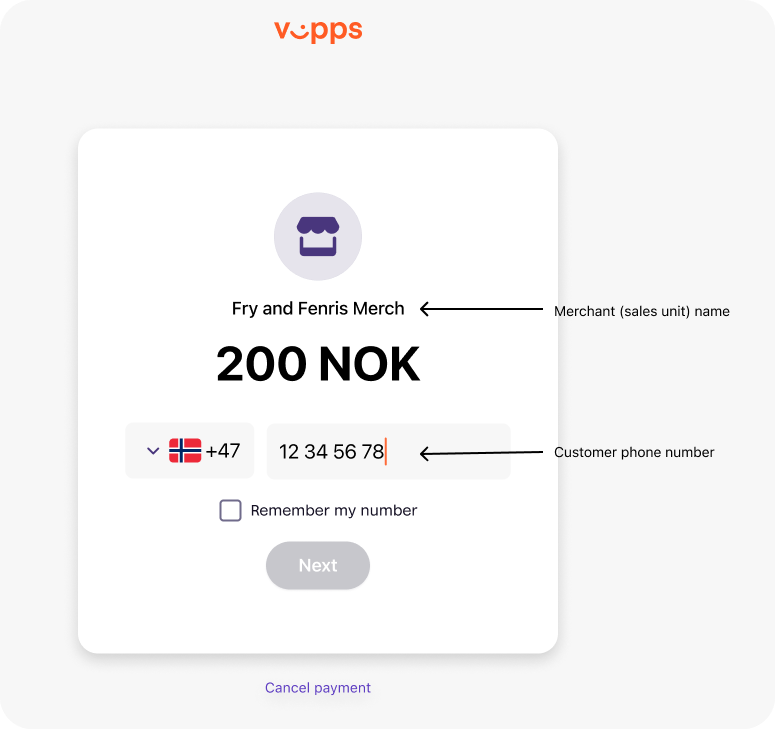

If the payment was started from a mobile device, the Vipps app should automatically open, but if the payment is initiated from a desktop, the Vipps landing page will open.

- Merchant (sales unit) name - The name of the store, app, or service. This is the name shown for the sales unit in the business portal.

- Customer phone number - This field can be prefilled through a payment API, or can be empty, allowing the customer to enter their own phone number.

These values for merchant name and company name are set when you create the merchant. For an explanation of the values as applies to you as a PSP, see the PSP Signup API guide. For a general description, see Knowledge base: landing page.

Skip landing page

Only available for whitelisted sales units.

Please note: This feature has to be enabled by Vipps for eligible sales units. The sales units must be whitelisted by Vipps. Skipping the landing page is typically used at physical points of sale where there is no display available.

For more details, see Knowledge base: Skip the landing page.

Lock phone number on landing page

This can be done when the merchant has verified the customer's identity. The PSP must support getting the "fixed" phone number from the merchant.

This measure aims to prevent users from sending payment requests to unauthorized recipients, and it is especially useful for selling digital assets or other products susceptible to fraud, such as gift cards and top-ups.

Payment confirmation

After the payment initiation, Vipps sends a push notification or redirects the user to the Vipps app. The user logs in, selects payment source, and confirms the payment.

makePaymentUrl

Once the Vipps user has confirmed the payment in the Vipps app, Vipps shares the network token

with the PSP by posting to the makePaymentUrl:

POST:makePaymentUrl.

Vipps requires a HTTP 200 OK response

and a response body with "paymentInfo.status": "OK"

for the POST request to the makePaymentUrl.

Vipps then sets the payment's status to RESERVED.

If Vipps does not receive the expected response, the payment's status will be FAILED.

The process of using POST to the makePaymentUrl is synchronous, and while Vipps

is waiting for a response from the PSP, the user will see a "spinner" in the

Vipps app.

After the successful POST to the makePaymentUrl,

the PSP uses the card token to process the payment through the acquirer.

This is the PSP's responsibility.

Vipps is not involved in the actual payment, Vipps only provides the

PSP with the card token.

Vipps does not have any information about the actual payment at this point.

The PSP then sends Vipps an update on the status of the payment:

POST:/psp/v3/psppayments/updatestatus

It is important that the PSP sends this update, so the user can see the correct status of the payment in Vipps. Without a status update from the PSP, the user will see an incorrect status.

The Vipps user receives confirmation of the payment in Vipps, and

Vipps redirects the end user to the redirectUrl provided during payment initiation.

Please note:

- The normal

timeouts

apply to the PSP API. If the user does not act on the payment request within 10 minutes,

Vipps will make a POST request towards the

makePaymentUrlwith a status oftimeout. - The

makePaymentUrlhas a timeout of 15 seconds. If no response is received within this period, Vipps will mark the transaction asFAILED. This is a known issue with the current API. Future improvements to address this issue are planned. - Some users may close Vipps immediately after seeing the payment confirmation,

therefore not being "redirected" back to the merchant. Because of this, it is important for the

merchant and the PSP to not base their transaction logic on the user reaching the

pspRedirectUrl.

isApp

See Knowledge base: App flow recommendations.

EMVCo Token processing

In order to give the best possible payment experience, the PSP API uses EMVCo token based processing.

The solution requires the PSP to have support for EMVCo token processing.

The makePaymentUrl call to the PSP sends the network token

and cryptogram in the following format. This is referred to as the makePayment request.

Authorization: makePaymentToken

{

"pspTransactionId": "7686f7788898767977",

"merchantSerialNumber": "123456",

"paymentState": "ACCEPTED/TIMEOUT/USER_CANCEL",

"paymentInstrument": "TOKEN",

"binNumber": "492556",

"networkToken": {

"number": "12345678901234",

"expiryMonth": "12",

"cryptogram": "aFgdgjdkfgjdFDF=",

"tokenType": "VISA",

"expiryYear": "2026",

"eci": "07"

}

}

Where networkToken is the Network token of the card, up to 16–19 digits.

Scheme specific details

Visa

Visa tokens must be processed with the acquirer submitting the TAVV cryptogram in field 126.8. The cryptogram received with the Network Token will contain the information for Delegated Authentication (DA) and the SCA factors used.

The Visa Token Service will during detokenization populate a flag for DA in field 34 to issuers and the Vipps TRID in field 123 Usage 2 Tag 03. In this way, Issuers recognize Vipps originated transactions and will not soft-decline for DS step-up unless the issuing bank has opted out of the Visa D-SCA program. The expected ECI value for VISA requests is ECI-07.

Mastercard

A MasterCard transaction should be processed as an eCom token in accordance with the acquirers instructions from Mastercard. Mastercard adds the Token Requestor ID (TRID) to the authorization message. It will always be available in DE48, SE33, SF6.

Token requestor IDs

For Visa/Mastercard, the Token Requestor ID (TRID) is an eleven-digit number. It is added by the scheme in the processing of the payments.

3DSecure and network tokens

In order to start a 3DS session, simply use the Network Token Number instead of the regular PAN. The scheme Directory Server maps the Network Token to the underlying PAN before it requests the challenge session from the Issuing Bank's ACS. CVC is not required in order to perform the 3DS session with a network token.

Once the 3DS CAVV cryptogram is acquired from the 3DS session, both the CAVV and the token cryptogram must be submitted in the authorization request in the fields specified by the acquirer. This is necessary to perform a valid authorization.

Magic numbers for EMVCo tokens

It is not possible to add payment cards in the test app.

Any request to the PSP API will return a Visa Token. However, this can be changed

by setting the amount in the init request.

No matter what is selected in the app,

the token returned by the MakePayment request will be:

| Amount Value (minor currency unit) | Token Number | Expiry | Cryptogram |

|---|---|---|---|

| 2200 | 5226603115488031 | 05/30 | AlhlvxmN2ZKuAAESNFZ4GoABFA== |

| 3100 | Emulates Card not eligible | ||

| 3200 | 4111111111111111 | 03/30 | uxToh3Ep6gsR8AAkvZALN19Iz34= |

| 4200 | 4895370013193500 | 03/30 | AlhlvxmN2ZKuAAESNFZ4GoABFA== |

| 4300 | 5226603115488031 | 03/30 | AlhlvxmN2ZKuAAESNFZ4GoABFA== |

| 4400 | 4895370012792682 | 12/30 | AgAAAAAAAIR8CQrXSohbQAAAAAA= |

| 5100 | 4268270087302871 | 09/30 | AgAAAAAAAIR8CQrXSohbQAAAAAA= |

| 5200 | 5413330089010442 | 12/30 | AgAAAAAAAIR8CQrXSohbQAAAAAA= |

| 5300 | 4895370013193500 | 03/30 | /wAAAAwAUkMTObMAAAAAgS0AAAA== |

| All other amounts | 4895370013193500 | 05/30 | AlhlvxmN2ZKuAAESNFZ4GoABFA== |

For instance:

"amount": 3100, Will emulate a card that is not eligible.

Status updates

To provide a consistent end user experience, it is important that Vipps is

notified by changes to the payment status when it is captured, cancelled, or refunded:

POST:/psp/v3/psppayments/updatestatus

Vipps also provides an endpoint allowing you to check the payment status:

GET:/psp/v3/psppayments/{pspTransactionId}/details

Please note: For single payments you do not need to send an update for the

reservation, since that is handled by the synchronous response to the

Makepayment call.

For customers upgrading from the PSP API v1: It is ok to call

POST:/psp/v3/psppayments/updatestatus

with the v3 API on payments done with the v1 API.

Cancelling pending transactions

A user might return to the PSP's checkout without logging in to the Vipps App, or they might abort the transaction in the Vipps App. Vipps's recommendation is that the PSP then cancels the transaction in their backend and returns an error code.

| 85 | Response received too late |

See: Error codes from Vipps.

A typical flow would be:

- The user selects Vipps as payment method.

- The user returns without completing in the app (no

makePaymentUrlrequest has been received by the PSP). - The PSP cancels the payment on their end and restarts the checkout.

- The user might end up going back to the Vipps app. If that happens and a

makePaymentUrlrequest is sent, the PSP responds with error code 85.

Example request:

Authorization: makePaymentToken

{

"pspTransactionId": "7686f7788898767977",

"merchantSerialNumber": "123456",

"paymentState": "ACCEPTED/TIMEOUT/USER_CANCEL",

"paymentInstrument": "TOKEN",

"binNumber": "492556",

"networkToken": {

"number": "12345678901234",

"expiryMonth": "12",

"cryptogram": "aFgdgjdkfgjdFDF=",

"tokenType": "VISA",

"expiryYear": "2026",

"eci": "07"

}

}

Example response:

{

"errorMessage": {

"errorId": 82,

"errorText": "Refused by Issuer"

},

"paymentInfo": {

"pspTransactionId": "7686f7788898767977",

"status": "FAIL"

}

}

Idempotency

Many API requests to Vipps APIs can be retried without any side effects

by providing Request-Id(or Idempotency-key) in the header of the

request.

See Idempotency header for more details.

PSD2 compliance and Strong Customer Authentication (SCA)

3DSecure fallback

In case of a soft decline (when the issuer requires 3DS), the PSP must host a 3DSecure session and must provide the URL to Vipps.

The format of the MakePaymentRequest response provided by the PSP in case of

a soft decline:

{

"errorMessage": {

"errorId": 1036,

"errorText": "Soft Decline"

},

"paymentInfo": {

"pspTransactionId": "7686f7788898767977",

"status": "SOFT_DECLINE",

"url3dSecure": "https://psp.com/3ds/123123"

}

}

The Vipps App will then open the URL in a web view, letting the user complete

the 3DSecure flow. The PSP must host and retrieve any necessary data

from the session. Once the session is completed, the PSP must finish with a

redirect according to the Operations.url object sent in the initial

makePayment request, whereupon the app will close the iframe. Vipps will

then resend the makePayment request.

For example, if a 3DSecure session succeeds, you should redirect to the

Operations.url with the operation 3dssuccess.

{

"operations": [

{

"url": "https://pe.vipps.no/payments/v1/web/softdecline-callback?token=abcdefg",

"operation": "3dssuccess"

}

]

}

Note that the token query parameter is critical.

When Vipps sends the status in the response to the second makePayment

request, it should never be SOFT_DECLINE, only FAIL or OK.

Once the status is returned, it will be displayed to the user as normal in the app.

Authorization: makePaymentToken

{

"pspTransactionId": "7686f7788898767977",

"merchantSerialNumber": "123456",

"confirmed": "YES/TIMEOUT/CANCEL",

"paymentInstrument": "TOKEN",

"binNumber": "492556",

"networkToken": {

"number": "12345678901234",

"expiryMonth": "12",

"cryptogram": "aFgdgjdkfgjdFDF=",

"tokenType": "VISA",

"expiryYear": "2026",

"eci": "07"

}

}

URL validation

All URLs in eCom API are validated with the Apache Commons UrlValidator.

If isApp is true, any pspRedirectUrl is not validated with Apache Commons UrlValidator,

as the app-switch URL may be something like vipps://, which is not a valid URL.

The endpoints required by Vipps must be publicly available.

URLs that start with https://localhost will be rejected. If you want to use

localhost as fallback, please use http://127.0.0.1.

It is not possible to use https://localhost or

http://127.0.0.1 for the callback, as the Vipps backend would then call itself.

Here is a simple Java class suitable for testing URLs,

using the dummy URL https://example.com/vipps/fallback-result-page/acme-shop-123-order123abc:

import org.apache.commons.validator.routines.UrlValidator;

public class UrlValidate {

public static void main(String[] args) {

UrlValidator urlValidator = new UrlValidator();

if (urlValidator.isValid("https://example.com/vipps/fallback-result-page/acme-shop-123-order123abc")) {

System.out.println("URL is valid");

} else {

System.out.println("URL is invalid");

}

}

}

Recommendations regarding handling redirects

Since Vipps is a mobile entity, the amount of control Vipps has over the redirect back to the merchant after the purchase is completed is limited. A merchant must not assume that Vipps will redirect to the exact same session and for example rely entirely on cookies in order to handle the redirect event. For example, the redirect could happen to another browser.

Examples of some, but not all, factors outside Vipps' control.

- Configurations set by the OS itself, for example the default browser.

- User configurations of browsers.

- Users closing app immediately upon purchase.

Therefore, Vipps recommends having a stateless approach in the site that is supposed to be the end session. An example would be a polling-based result handling from a value in the redirect URL.

For demonstration purposes, an example that should be handled is:

- User starts is in web session in a Chrome Browser.

- A Vipps purchase is started, a redirect URL is defined by the Merchant.

- The user completes the purchase.

- The Vipps app redirects the user.

- The OS defaults to a Safari Browser for the redirect.

- The merchant handles the redirect without the customer noticing any discrepancies from the browser switch.

Errors

Responses and error codes from Vipps

HTTP responses from Vipps

This API returns the following HTTP statuses in the responses:

| HTTP status | Description |

|---|---|

200 OK | Request successful |

400 Bad Request | Invalid request, see the error for details |

401 Unauthorized | Invalid credentials |

403 Forbidden | Authentication ok, but credentials lacks authorization |

404 Not Found | The resource was not found |

500 Server Error | An internal Vipps problem |

Error codes from Vipps

This API returns the following error codes:

| Error code | Error message | Description |

|---|---|---|

21 | Merchant not available or active | |

42 | Invalid payment model type | |

44 | PSP Transaction ID already exists | |

51 | Invalid request | |

51 | Invalid pspRedirectUrl | |

99 | OrderId already exists | |

amount | amount.less.than.one | |

currency | transaction.currency.invalid | |

makePaymentUrl | Invalid makePaymentUrl | |

121 | Agreement not found | The agreement does not exist |

122 | Agreement not active | The agreement has been deactivated via the Delete agreement endpoint |

123 | Connected payment source not active for Agreement | The connected card is no longer active or valid |

124 | No Network token available for this Agreement | The connected card does not have an active network token available |

Error codes from the PSP

The PSP should return errors with the following errorId and errorText fields, when applicable:

errorId | errorText | Description (should not be included in response) |

|---|---|---|

| 71 | Invalid request | The request received from Vipps failed validation. |

| 72 | Different texts | For errors that are not in this list. Please include text describing the error. |

| 81 | No such issuer | The PSP were unable to identify the card issuer. |

| 82 | Refused by Issuer | Generic response for cards that were refused by issuer, without the PSP knowing why. |

| 83 | Suspected fraud | Suspected fraud. |

| 84 | Exceeds withdrawal amount limit | The amount exceeds an amount limit. Could be per transaction limit, or for a period. |

| 85 | Response received too late | A third party didn't respond in time for the makePayment or Cancelling pending transactions. |

| 86 | Expired card | Expired card. |

| 87 | Invalid card number (no such number) | The card provided is invalid. |

| 88 | Merchant does not allow credit cards | If the PSP supports disallowing credit cards. |

| 89 | Insufficient funds | Insufficient funds. |

| 91 | Internal error | Unhandled or unknown exception. |

| 93 | Status from Vipps:CANCEL | Response to Vipps sending CANCEL. Caused by customer cancelling the payment from the Vipps App, or in the Vipps landing page. |

| 93 | Status from Vipps:TIMEOUT | Response to Vipps sending TIMEOUT. Caused by customer not acting on the payment. This will happen within 5–10 minutes of the customer not acting. Vipps immediately processes and sends the TIMEOUT notification to the PSP |

| 93 | Status from Vipps:NO | Response to Vipps sending NO. Something failed during payment approval. Often caused by failure to retrieve and send networkToken. |

| 94 | Unhandled soft decline | Response to a Soft Decline from the bank that could not be processed or forwarded to the Vipps App. |

Differences from previous versions

Differences from PSP API v2 to v3

The PSP API v3 adds functionality for network tokens and allows PSPs to use the API to obtain tokens from Vipps, not the actual card details.

Additionally, $.makePaymentRequest.confirmed has been renamed to $.makePaymentRequest.paymentState

Values for this enum have changed accordingly:

| Old Value | New Value |

|---|---|

| Yes | ACCEPTED |

| TIMEOUT | TIMEOUT |

| CANCEL | USER_CANCEL |

| NO | USER_CANCEL |

Differences from PSP API v1 to v2

- Added support for redirection of user after payment completion in the Vipps app

- Added support for providing the

makePaymentUrlin the initiate payment call - Improved authorization of the

makePaymentUrlcall by adding theAuthorizationheader value - Improved and more consistent parameter names in the API