Recurring API guide

The Vipps MobilePay Recurring API delivers recurring payment functionality for a merchant to create a payment agreement with a customer for fixed interval payments. When the agreement is accepted by the end user, the merchant can send charges that will be automatically processed on the due date.

General

Requirements

The Recurring API requires additional compliance checks, beyond those required for the ePayment API, as mandated by financial regulatory authorities.

To get access to the Recurring API in production:

-

If you do not already have a sales with access to the eCom/ePayment API: Please order Recurring Payments. It is the same order form as Payment Integration (ePayment API). You will then get a new sales unit (MSN) that can be used for recurring payments.

-

For an existing sales unit that already has access to the eCom/ePayment API: Please log in on the business portal, select the existing sales unit, and on the sales unit details page: Click

Addnext to "Recurring Payments". You will then get access to the Recurring API for the existing sales unit.

Please have this information ready:

- Estimated total annual turnover for the sales unit. Example: 100 MNOK.

- Percentage of the payment volume that will be through recurring payments. Example: 50 MNOK.

- The length of the agreements. Example: Annual and monthly.

- The distribution (in %) of the agreement intervals. Example: 80 % annual, 20 % monthly.

You can check if you have access to the Recurring API:

- As a merchant: Check your sales unit(s) on the business portal, on the sales unit details page, or in the Developer section.

- As a partner: Check the sales unit(s) on the partner portal (View your sales units) or with the Management API.

Terminology

| Term | Description |

|---|---|

| Agreement | A payment agreement with a set of parameters that a customer agrees to. |

| Charge | A single payment within an agreement. |

| Idempotency | The property of endpoints to be called multiple times without changing the result after the initial request. |

| Direct capture | A transaction type where payment is immediately processed. |

| Reserve capture | A transaction type where payment is reserved for later capture. |

| Recurring charge | A scheduled payment linked to a recurring agreement. |

| Unscheduled charge | A one-time or sporadic payment not tied to a fixed schedule. |

| Retry days | The number of days during which failed charges are retried. |

| Campaign | A temporary pricing modification for agreements (e.g., price reductions for a specific period or event). |

| Partner key | An authentication method for partners making API calls on behalf of merchants. |

| Merchant Serial Number (MSN) | A unique identifier for a merchant's sales unit. |

| Flexible pricing | A pricing model allowing variable amounts for charges. |

| Interval | The frequency of recurring charges (e.g., daily, weekly, monthly). |

| Webhook | A notification mechanism to inform merchants of events such as agreement cancellations. |

| Merchant agreement URL | A link where customers can manage their agreements on the merchant's platform. |

Payment amounts

All amounts are specified in minor units.

For example:

- NOK and DKK: 1 kr = 100 øre

- EUR: 1 Euro = 100 cent.

The maximum amounts allowed are:

- NOK: 20 000 kr (2000000 øre)

- DKK: 300 000 kr (30000000 øre)

- EUR: 2 000 Euro (200000 cent)

The minimum amounts allowed are: NOK 100 øre, DKK 1 øre, EUR 1 cent

Flow

The overall flow is:

- The merchant creates a draft agreement and proposes it to the customer via Vipps MobilePay.

- The customer approves the agreement in Vipps MobilePay.

- The customer can find a full overview of the agreement in Vipps MobilePay, including a link to the merchant's website.

- The merchant sends a charge request to Vipps MobilePay at least one day before due date

- If the agreement is active, Vipps MobilePay authorizes the charge.

- Charge will be processed on due date.

Simplified flow

For more examples of the flow, see the How it works guides.

Authentication and authorization

All API calls are authenticated with an access token and an API subscription key. See Request an access token, for details.

Use the standard HTTP headers for all requests.

Partner keys

In addition to the normal Authentication we offer partner keys, which let a partner make API calls on behalf of a merchant.

If you are a Vipps MobilePay partner who is managing agreements on behalf of Vipps MobilePay merchants, you

can use your own API credentials to authenticate, and then send

the Merchant-Serial-Number header to identify which of your merchants you

are acting on behalf of. The Merchant-Serial-Number must be sent in the header

of all API requests.

By including the HTTP headers you will make

it easier to investigate problems, if anything unexpected happens. Partners may

re-use the values of the Vipps-System-Name and Vipps-System-Plugin-Name in

the plugins headers if having different values do not make sense.

Here's an example of headers (please refer to the Recurring API specification for all the details):

Authorization: Bearer eyJ0eXAiOiJKV1QiLCJhbGciOiJSUzI1Ni <snip>

Ocp-Apim-Subscription-Key: 0f14ebcab0ec4b29ae0cb90d91b4a84a

Merchant-Serial-Number: 123456

Vipps-System-Name: acme

Vipps-System-Version: 3.1.2

Vipps-System-Plugin-Name: acme-pos

Vipps-System-Plugin-Version: 4.5.6

Content-Type: application/json

Please note: The Merchant Serial Number (MSN) is a unique ID for the sale unit. This is a required parameter if you are a Vipps MobilePay partner making API requests on behalf of a merchant. The partner must use the merchant's MSN, not the partner's MSN. This parameter is also recommended for regular Vipps MobilePay merchants making API calls for themselves.

Call by call guide

There are two happy-flows based on how the sales unit is set up:

One for "direct capture" and one for "reserve capture".

This is specified with the transactionType, and for "direct capture"

the sales unit must be configured for this by Vipps MobilePay.

For more details, see Knowledge base: Reserve capture vs direct capture.

Please note: Vipps MobilePay will only perform a payment transaction on an agreement that

the merchant has created a charge for with the POST:/recurring/v3/agreements/{agreementId}/charges endpoint.

Direct vs. reserve capture setup

Direct capture

For a "transactionType": "DIRECT_CAPTURE" setup, the normal flow would be:

- Create a (draft) agreement using the

POST:/recurring/v3/agreementsendpoint. The user can now confirm the agreement in Vipps MobilePay (the app). See Create a new agreement. - The user approves the agreement in Vipps MobilePay: This will result in a capture (or reserve) of the initial charge (if one was defined in the first step). See Initial charge.

- Retrieve the agreement by calling the

GET:/recurring/v3/agreements/{agreementId}endpoint. See Retrieve an agreement. Please note: At this point the agreement will beACTIVEif the user completed step 2. - All future charges can be created by using the

POST:/recurring/v3/agreements/{agreementId}/chargesendpoint. For direct capture you must set"transactionType": "DIRECT_CAPTURE". See Create a charge. Based on thedueset in the request, we will try to process the charge on that day. If for some reason, a charge fails to be processed, we will retry for the number of days specified by theretryDaysvalue. We strongly recommend at least two days retry:retryDays: 2.

Reserve capture

For a "transactionType": "RESERVE_CAPTURE" setup, the normal flow would be:

- Create a (draft) agreement using the

POST:/recurring/v3/agreementsendpoint. The user can now confirm the agreement in the Vipps or MobilePay

or MobilePay  app. See Create a new agreement.

app. See Create a new agreement. - The user approves the agreement in Vipps MobilePay: This will result in a capture (or reserve) of the initial charge (if one was defined in the first step). See Initial charge.

- Retrieve the agreement by calling the

GET:/recurring/v3/agreements/{agreementId}endpoint. See Retrieve an agreement. Please note: At this point the agreement will beACTIVEif the user completed step 2. - All future charges can be created by using the

POST:/recurring/v3/agreements/{agreementId}/chargesendpoint. For reserve capture you must set"transactionType": "RESERVE_CAPTURE". See Create a charge. Based on thedueset in the request, we will try to process the charge on that day. If the charge is processed successfully, the status will beRESERVED. If for some reason, a charge fails to be processed, we will retry for the number of days specified by theretryDaysvalue. We recommend at least 2 days retry. - If there is a product that is shipped to the customer, the charge should be captured at this point.

Capture the charge by calling the

POST:/recurring/v3/agreements/{agreementId}/charges/{chargeId}/captureendpoint.

API endpoints

See Authentication and authorization.

See the Quick start guide for en easy way to test the API.

Agreements

An agreement is between the Vipps MobilePay user and the merchant. The agreement allows you to routinely charge the customer without requiring them to manually approve every time. You can check the status of the user's agreement: Retrieve an agreement.

How agreements work

The merchant initiates by creating a draft agreement, presenting it to the customer via Vipps MobilePay. Once approved by the customer, the merchant can schedule charges that Vipps MobilePay automatically processes on the specified due dates. See charges for more details.

Card updates and recurring charges

Recurring agreements do not automatically update to a new payment card when users add or change cards in the Vipps  or MobilePay

or MobilePay  app. This ensures users can control which cards are linked to specific agreements.

app. This ensures users can control which cards are linked to specific agreements.

When users add or update a card, they are prompted to update the linked agreements. If they skip this step, they will be notified about the consequences.

Converting existing customers to Vipps MobilePay

Make switching to Vipps MobilePay Recurring effortless for your customers by sharing a unique URL or QR code in your communication channels:

- In emails: Link to a page where they can set up Vipps MobilePay.

- In PDF invoices: Include a URL or QR code for mobile-friendly access.

- On paper invoices: Add a QR code, so customers can scan and pay easily. Keep it simple, clear, and convenient to encourage adoption.

Retrieving user information

Merchants can retrieve user information with the user's consent. This must be done when creating an agreement, using the Profile Sharing feature and specifying the correct scope.

- For implementation details, refer to Profile Sharing.

- The information is accessible for a limited time after consent is given.

- For further details, refer to the Userinfo API.

Looking up users linked to an agreement

Merchants cannot directly look up a user associated with an agreement. Instead:

- Use

Profile Sharingto collect the user's information during agreement creation, with their consent. - Refer to:

Create an agreement

This is an example of a request body for the POST:/recurring/v3/agreements call:

{

"phoneNumber":"4712345678",

"interval": {

"unit" : "MONTH",

"count": 1

},

"merchantRedirectUrl": "https://example.com/confirmation",

"merchantAgreementUrl": "https://example.com/my-customer-agreement",

"pricing": {

"amount": 49900,

"currency": "NOK"

},

"productDescription": "Access to all games of English top football",

"productName": "Premier League subscription"

}

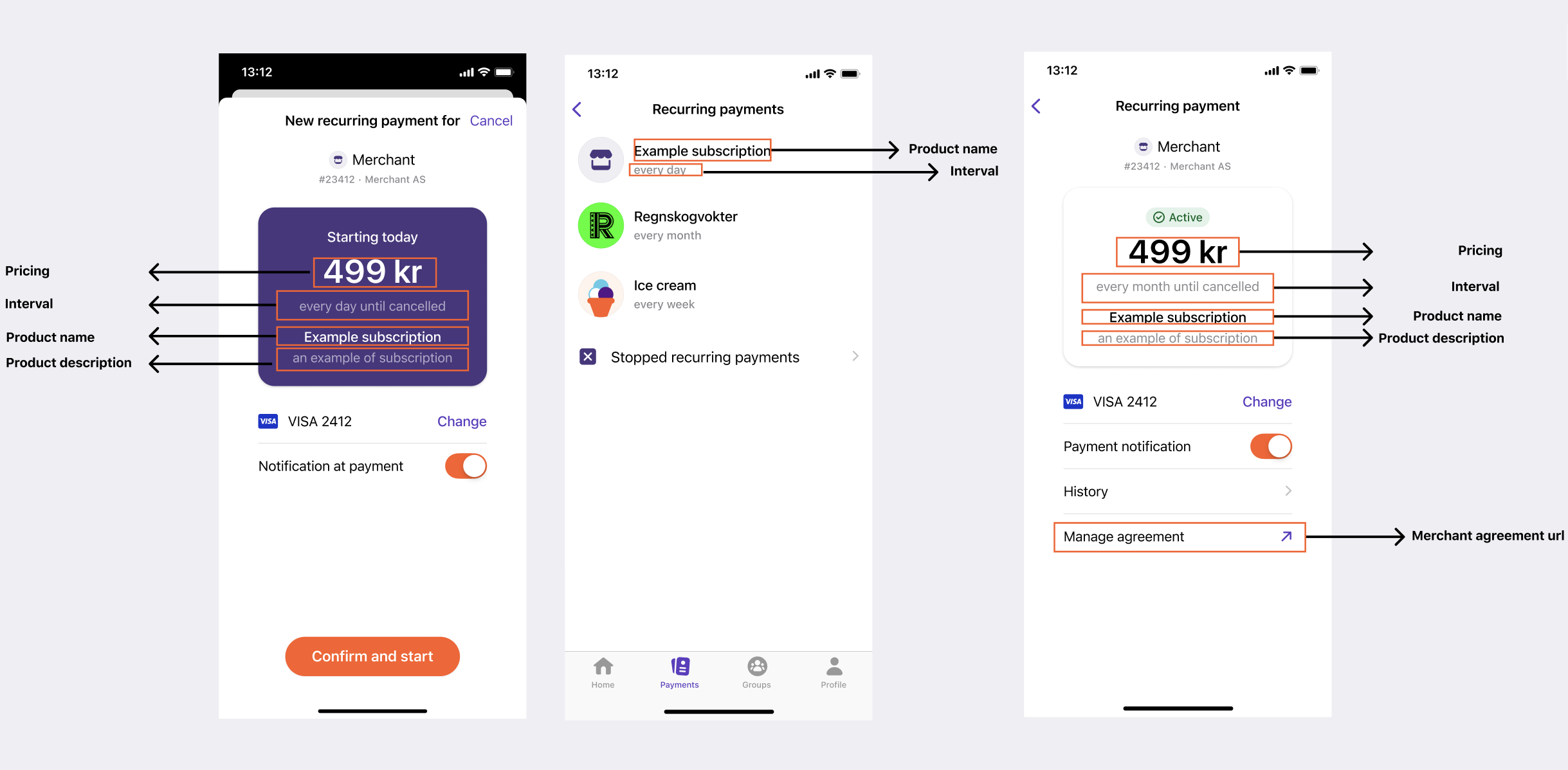

Agreement fields and their usage in the Vipps or MobilePay app

pricing: Price of the subscription.interval: Describes how often the user will be charged.productName: A short description of the subscription. Will be displayed as the agreement name in the Vipps or MobilePay app.productDescription: More details about the subscription. Optional field.merchantAgreementUrl: URL where you will send the customer to view/manage their subscription. See Merchant agreement URL for more details.

Please note: To create agreements with support for variable amounts on charges, see Recurring agreements with variable amount.

Agreements may be initiated with or without an initial charge.

If a payment is required to activate an agreement, you need to specify an initial charge.

If you are dealing with physical goods, this should be a RESERVE_CAPTURE,

but for digital goods where the customer instantly gains access, DIRECT_CAPTURE might be easier to manage.

See Initial charge.

The agreement price and the amount for the initial charge (if applicable), is given in øre for NOK and DKK, and in cent for EUR. The minimum amounts allowed are: NOK 100 øre, DKK 1 øre, EUR 1 cent.

| # | Agreement | Description |

|---|---|---|

| 1 | Agreement starting now | Agreement with an initialcharge that uses DIRECT_CAPTURE will only be active if the initial charge is processed successfully |

| 2 | Agreement starting in future | Agreement without an initialcharge, or with initialcharge that uses RESERVE_CAPTURE, can be approved, but no payment will happen until the first charge is provided |

Once you initiate the request, you'll receive a response containing the vippsConfirmationUrl parameter.

Use this URL to redirect the user:

- In a desktop flow, redirect to the Vipps MobilePay landing page.

- In a mobile flow, redirect to the Vipps

MobilePay

MobilePay  app.

app.

From there, the user can approve or reject the agreement.

By default, this URL uses the https:// scheme, which manages redirection automatically.

Thanks to "universal linking", the phone’s operating system recognizes that https://api.vipps.no

should open the Vipps MobilePay app rather than the default web browser.

Please note: In some cases, the user may need to approve opening the Vipps MobilePay app. This prompt typically only appears the first time the app is opened.

If the user doesn’t have the Vipps MobilePay app installed, the Vipps MobilePay landing page will appear. There, they can enter their phone number and complete the payment on another device that has Vipps MobilePay installed.

If the payment is initiated in a native app, it is possible to explicitly force

a vipps:// URL by sending the "isApp": true parameter in the initiate call.

If the user doesn't have the Vipps MobilePay app installed,

they will see an error message stating that the link cannot be opened.

This approach is strongly discouraged, and it comes with extra responsibility for security and usability reasons.

Response for create agreement request

The POST:/recurring/v3/agreements endpoint will return the following JSON structure.

{

"vippsConfirmationUrl": "https://api.vipps.no/dwo-api-application/v1/deeplink/vippsgateway?v=2/token=eyJraWQiOiJqd3RrZXkiLCJhbGciOiJSUzI1NiJ9.eyJzdWIiOiJmMDE0MmIxYy02YjI",

"agreementId": "agr_TGSuPyV"

}

agreementId- Contains a unique identifier for the agreement request. This can be used to fetch the agreement status in theGET:/recurring/v3/agreements/{agreementId}request.vippsConfirmationUrl- Provides the URL that should be used to redirect the user to the Vipps MobilePay landing page in a desktop flow, or to Vipps MobilePay in a mobile flow.

Agreement activation or rejection

If the user accepts or rejects the agreement the user will be redirected back to themerchantRedirectUrl.

Activation of the agreement is not guaranteed to be finished by the time the user is redirected back to the merchantRedirectUrl.

The agreement could still have the status PENDING.

Also, if the user closes the Vipps or MobilePay app before the redirect is done, the merchantRedirectUrl will not be used.

Therefore, it is important to actively check the agreement's status with the

GET:/recurring/v3/agreements/{agreementId} endpoint instead of relying on the redirect to the merchantRedirectUrl.

See current rate limits for more details about polling.

Once a final status (ACTIVE, EXPIRED or STOPPED) is returned by the API, the agreement can be updated in your system.

Agreement states

| # | State | Description |

|---|---|---|

| 1 | PENDING | Agreement has been created, but not approved by the user in the Vipps or MobilePay app yet |

| 2 | ACTIVE | The agreement has been confirmed by the end user in the Vipps or MobilePay app and can receive charges |

| 3 | STOPPED | Agreement has been stopped, either by the merchant by the PATCH:/recurring/v3/agreements/{agreementId} endpoint, or by the user by cancelling or rejecting the agreement. |

| 4 | EXPIRED | The user did not accept, or failed to accept (due to processing an initialCharge), the agreement in the Vipps or MobilePay app |

Retrieve an agreement

A newly created agreement will be in status PENDING for 10 minutes before it expires.

If the customer approves the agreement, and the initialCharge (if provided) is successfully

processed, the agreement status will change to ACTIVE.

The approved agreement is retrieved from the

GET:/recurring/v3/agreements/{agreementId} endpoint

with "status":"ACTIVE" when the customer has approved the agreement. It is important to keep retrieving the agreement until the status is ACTIVE, STOPPED or EXPIRED.

See Agreement states.

This is an example response from a call to the

GET:/recurring/v3/agreements/{agreementId} endpoint:

{

"id": "agr_ADbq4JK",

"created": "2018-08-22T12:59:56Z",

"start": "2018-08-22T13:00:00Z",

"stop": null,

"status": "ACTIVE",

"productName": "Premier League subscription",

"productDescription": "Access to all games of English top football",

"pricing": {

"type": "LEGACY",

"amount": 49900,

"currency": "NOK"

},

"interval": {

"unit" : "MONTH",

"count": 2,

"text": "every 2 months"

},

"campaign": null,

"merchantAgreementUrl": "https://www.example.com/subscriptions/1234/",

"uuid": "6080c099-d7f2-43ef-a82b-2991ccc3a239",

"countryCode": "NO"

}

Update an agreement

You can update certain properties of a payment agreement. However, it is not possible to change the agreement type—for example, you cannot convert pricing.type: LEGACY to pricing.type: FLEXIBLE, or pricing.type: VARIABLE to pricing.type: FLEXIBLE.

A merchant can update an agreement by calling the

PATCH:/recurring/v3/agreements/{agreementId} endpoint.

The following properties are available for updating:

{

"productName": "A new name",

"productDescription": "A new description",

"merchantAgreementUrl": "https://example.com/subscriptions/1234/",

"pricing": {

"amount": 25000,

"suggestedMaxAmount": 300000

},

"interval": {

"type": "RECURRING",

"period": {

"count": 1,

"unit": "MONTH"

}

}

}

Updating amount is only possible for agreements with pricing.type:LEGACY

Updating suggestedMaxAmount is only possible for agreements with pricing.type:VARIABLE

You can also update the type of the interval. For instance, to make a recurring agreement flexible,

you can change the interval to FLEXIBLE, by sending the following payload:

{

"interval": {

"type": "FLEXIBLE"

}

}

Please note: As a PATCH operation all parameters are optional. However,

when setting an agreement status to STOPPED no other changes are allowed.

Attempts at changing other properties while stopping an agreement will result

in a 400 Bad Request response.

Pause and stop agreement

Pause an agreement

Today unfortunately we do not have a pause/freeze status. This is something we are looking into. If there should be a pause in an agreement, like a temporary stop of a subscription: Simply do not create any charges during the pause. We recommend to use Agreement Description to communicate to the user that the agreement is paused/frozen.

We recommended not to set the agreement status to STOPPED. STOPPED agreements cannot be reactivated.

Stop an agreement

When a user notifies the merchant that they want to cancel a subscription or

service, the merchant must ensure that the status of the recurring agreement is

set to STOPPED at a suitable time.

A merchant can stopped an agreement by calling the PATCH:/recurring/v3/agreements/{agreementId} endpoint.

Request body for stopping an agreement:

{

"status": "STOPPED"

}

Stopping an agreement results in cancellation of any charges that are DUE/PENDING/RESERVED at the time of stopping it,

and it will not be possible to create new charges for a stopped agreement.

Note : Charges with status RESERVED will not be cancelled if the stop of the agreement comes from the user side.

We recommend that the recurring agreement remains ACTIVE for as long as the

user has access to the service.

For example; if the user cancels their subscription, but they are still able to

use the service until the end of the billing cycle, the agreement should only be

set to STOPPED at the end of the billing cycle.

Since STOPPED agreements cannot be reactivated, a benefit of waiting until

the "end of service" before setting the agreement status to STOPPED is that

the merchant will be able to reactivate the user's subscription without having

to set up a new agreement.

What happens to the charges when a user stops their agreement in the app?

Existing RESERVED charges are not cancelled; merchants have the option to either capture or cancel the reservation.

All DUE/PENDING charges are cancelled.

Webhook Notification for agreement cancellation

We send the

recurring.agreement-stopped.v1 webhook event

to inform merchants that the users have stopped their agreement in the app.

Merchants must listen to this event.

The actor field in the payload will indicate if it was stopped by the merchant or the user.

In addition, merchants can poll and get the status of the agreement, when needed.

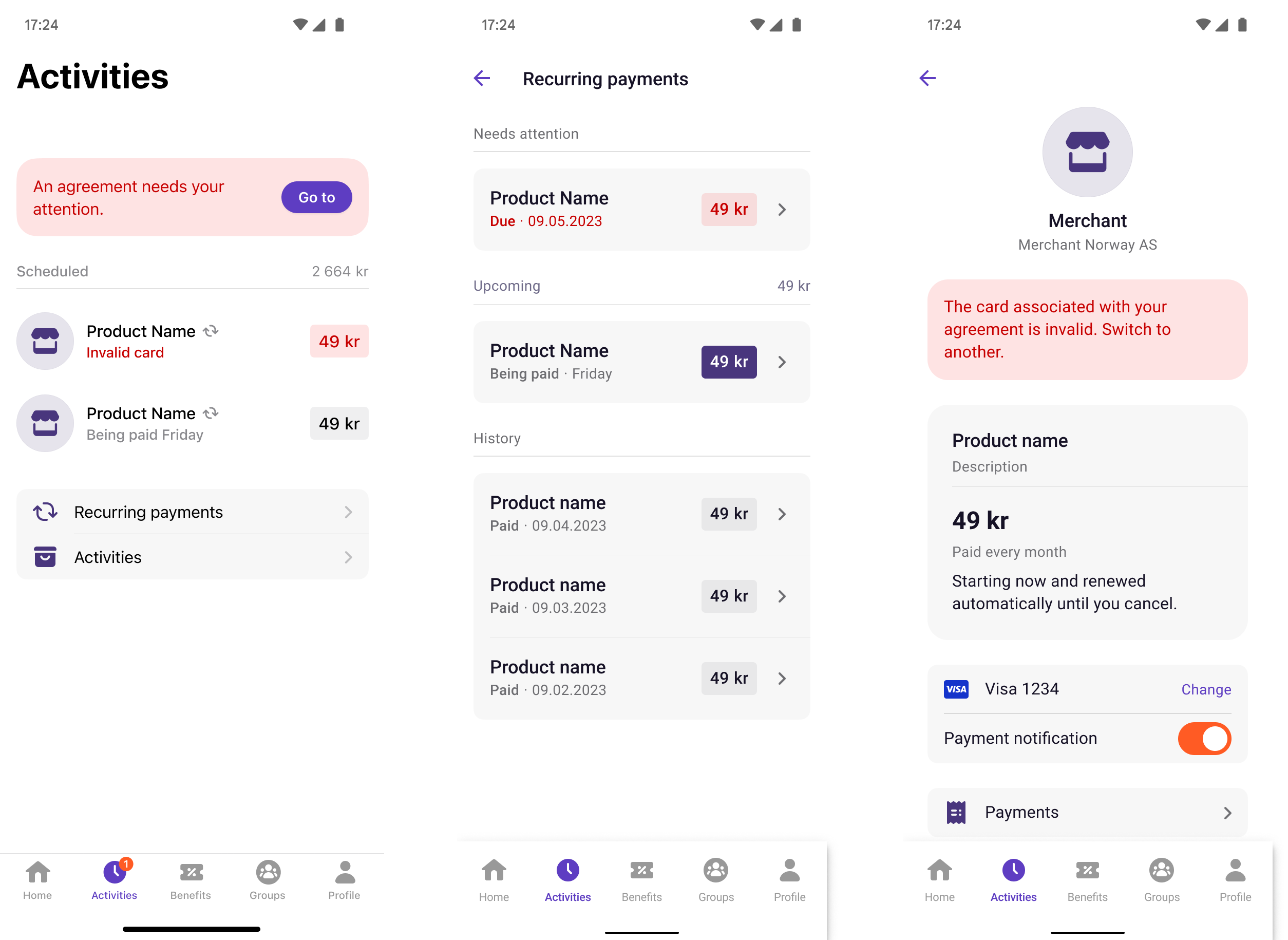

Stopping an agreement in the Vipps MobilePay app

Users can administer their agreements either in the Vipps  or MobilePay

or MobilePay  app or through the merchant.

When the user stops their payment agreement in the app,

the merchant must ensure the status of the subscription on their systems is updated and has the correct state.

app or through the merchant.

When the user stops their payment agreement in the app,

the merchant must ensure the status of the subscription on their systems is updated and has the correct state.

- Merchants must listen to the

recurring.agreement-stopped.v1webhook event. - The

actorfield in the payload will indicate if it was stopped by the merchant or the user. - In addition, merchants can poll and get the status of the agreement when needed.

- Already reserved charges are not cancelled. Merchants can either capture or cancel the reservation.

- All due/pending charges are cancelled.

Merchant agreement URL

The merchantAgreementUrl is a link to the customer's account page on your website, where they

can manage the agreement (e.g., change, pause, cancel the agreement).

The URL must lead the user to the page where the agreement is managed, not to the front page of the merchant's website, etc.

The URL is opened in the standard web browser by our app, not in a web view or similar.

Important: The integrator must implement such functionality for the

customer to manage the agreement in their system.

It is the integrator's responsibility to make sure the merchantAgreementUrl

in the agreement works for the user.

We don't have any specific requirements for the security of the page, other than using HTTPS, but we strongly recommend using Login, so the user does not need a username or password, but is logged in automatically through Vipps MobilePay. See the Login API for more details.

Opting out of the Stop Payment Agreement feature

KAM merchants (merchants that have a Key Account Manager in Vipps MobilePay) are able to "opt out" of the "stop payment agreement" functionality in our app. This means that users can only stop payment agreements on the merchant's website (or app). We discourage this, but if the merchants have a very strong reason, they can request to opt out, provided they meet the below requirements. By opting out, the merchant will miss the future functionalities we build on managing agreements in our app (pause, up-/downgrade, etc.). In the future, there might be a fee that the merchant has to pay to be on the opt-out list.

KAM merchants (merchants that have a Key Account Manager in Vipps MobilePay) are able to "opt out" of the "stop payment agreement" functionality in our app. This means that users can only stop payment agreements on the merchant's website (or app). We discourage this, but if the merchants have a very strong reason, they can request to opt out, provided they meet the below requirements. By opting out, the merchant will miss the future functionalities we build on managing agreements in our app (pause, up-/downgrade, etc.). In the future, there might be a fee that the merchant has to pay to be on the opt-out list.

Requirements:

- Provide a valid

merchantAgreementUrlin the API request when creating every agreement, as per the API specification and also update the existing agreements if they do not have themerchantAgreementUrlset. This is a requirement for all agreements, but extra important to ensure when there is no "stop agreement" functionality available in our app. If the URL changes you must update the agreement. - Submit proof of how the

merchantAgreementUrlflow works: Screenshots, video, etc. We need a clear understanding of what the user experiences when accessing themerchantAgreementUrl. - Agree that, if we receive numerous complaints from users about difficulties terminating agreements through the merchant's My Page or due to unhelpful customer service, the merchant will be removed from the opt-out list, and users will be able to stop agreements directly in our app.

How to request opt-out:

Merchants must email developer@vippsmobilepay.com with the following information:

- Merchant Serial Number(s) to be configured for opt-out of cancelling agreement in our app.

- A detailed reason for opting out.

- Proof of how the

merchantAgreementUrlflow works: Screenshots, video, etc.

Agreement types and use cases

Vipps MobilePay recurring payments is a fairly flexible service that allows merchants to tailor the user experience in the Vipps or MobilePay app by utilizing the normal agreements, initial charges, campaigns, or a combination of those.

This can be a bit confusing when deciding on which implementation to use. In short, our advice is to implement support for all our flows, and also implement features in your own systems for moving between the flows depending on the use case.

1. Normal agreement

This is the preferred flow whenever there is no campaign or no required payment on the start of an agreement.

In the normal agreement, the user gets presented with the agreement, agrees to it, and gets sent to a confirmation screen.

On the agreement we present the start date, the price of the agreements, the productName and the product description which are all defined by the merchant.

We also present an agreement explanation which is used to describe the agreement interval to the user.

For example, for an agreement with interval.unit=YEAR and interval.count=1, the agreement explanation will be hvert år til du sier opp or every year until cancelled

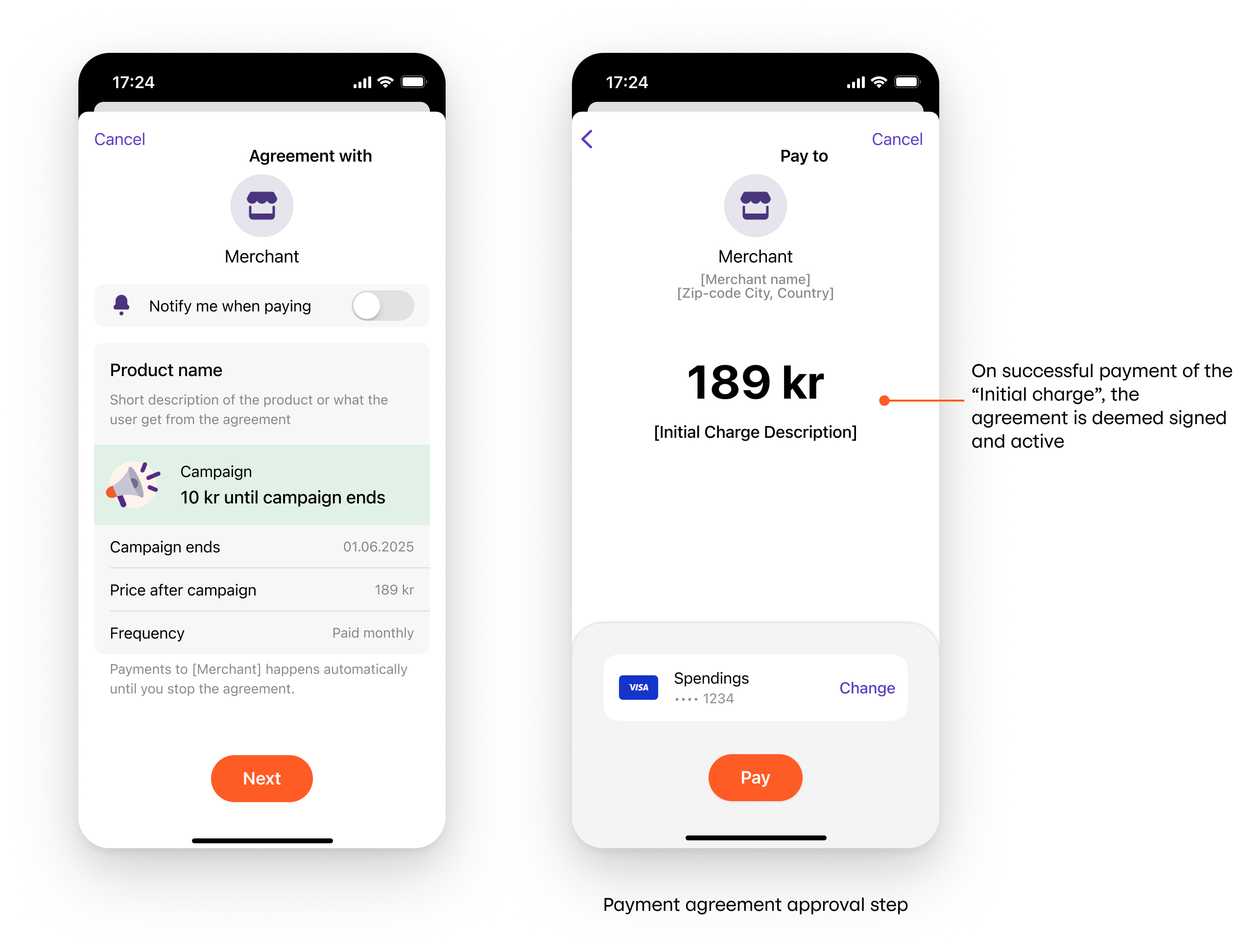

2. Agreement with initial charge

If you require a payment to be completed at the same time that the agreement is created, you must use Initial charge.

When an initial charge is present and the amount is different from the agreement price (or campaign price), the flow in the app will change. First the user gets presented with an overview over both the agreement and the initial charge. Then, when the user proceeds to confirm the agreement, the payment of the initial charge will be processed.

Here we also show productName and the agreement explanation on the agreement, as well as description on the initial charge.

productName and initial charge description are defined by the merchant.

The agreement explanation is created by automatically based on the interval and the campaign, if specified.

Initial charges are designed to be used whenever there is an additional cost in setting up the agreement. This could be bundling of a mobile phone together with a mobile subscription, or a TV setup-box when becoming a customer at a cable company. We do not recommend this flow to be used purely for campaigns, as it could be confusing to the user.

As an example: If you have a campaign of 10 NOK for a digital media subscription for 3 months, and the normal price is 299,- monthly, the user would see both the charge of 10 NOK, and have to confirm the agreement for 299,- monthly, which can lead the user to believe that both will be paid upon entering the agreement.

See How it works with initial charge

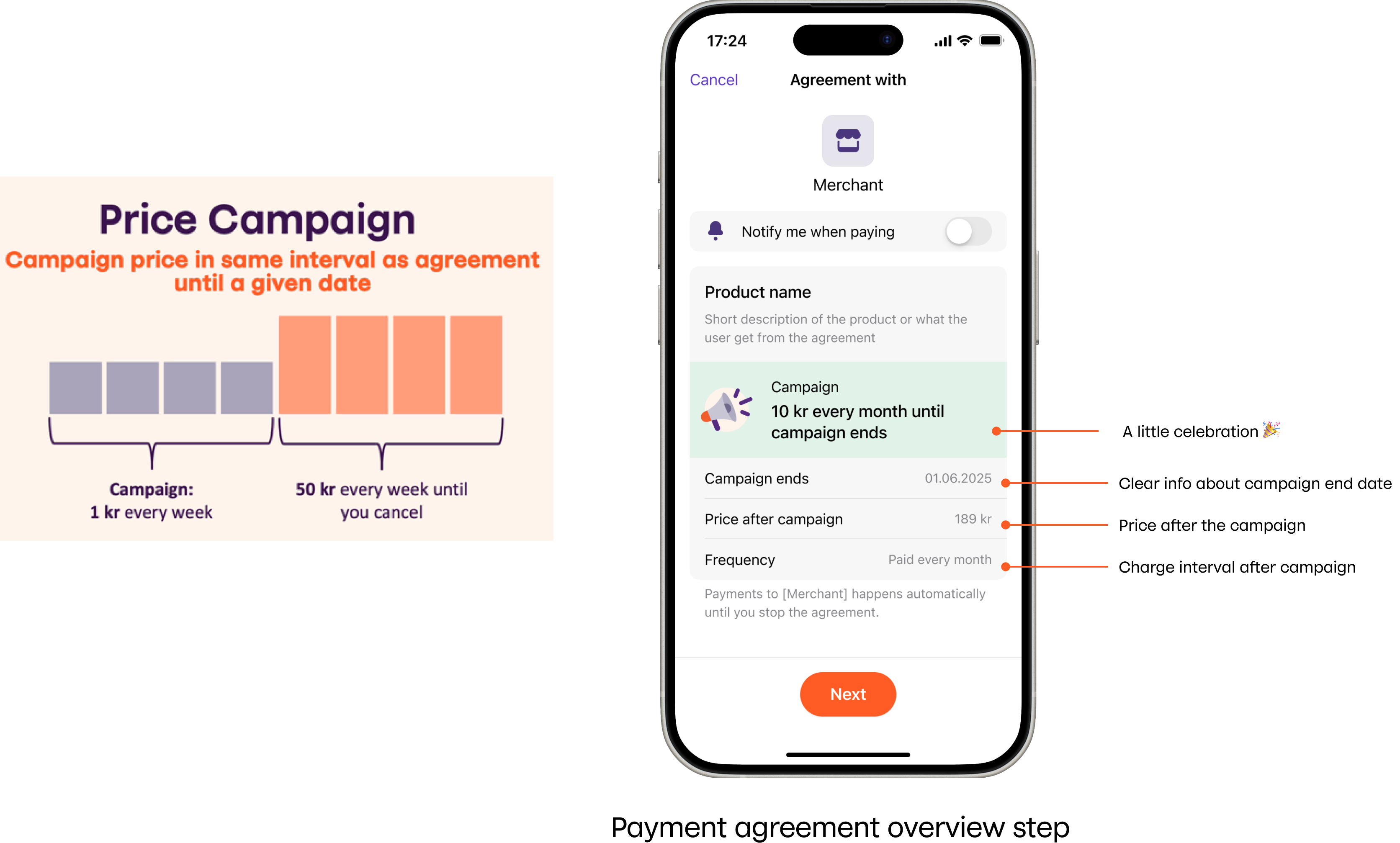

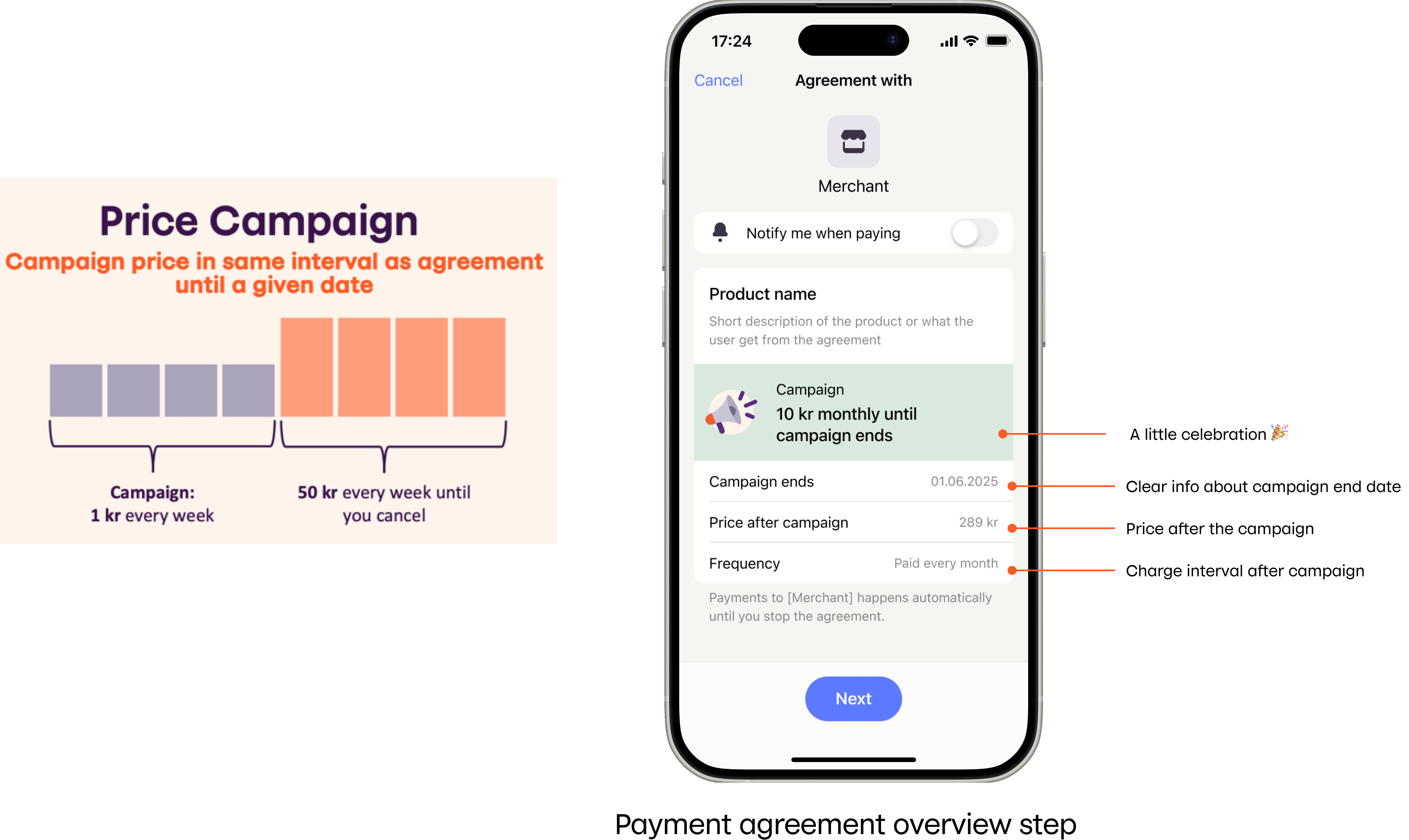

3. Agreement with campaign

This is the preferred flow whenever you have a type of campaign where the subscription has a certain price for a certain interval or time, before it switches over to ordinary price.

See Campaigns and How it works: Campaigns for details about campaigns.

When setting a campaign, this follows the normal agreement flow - with some changes. Instead of showing the ordinary price of the agreement, the campaign price will override this, and the ordinary price will be shown below together with information about when the change from the campaign price to the ordinary price will happen.

Please note: Campaign is not supported for variableAmount agreements.

4. Agreement with initial charge and campaign

Ideally, this flow is intended for when you have a combination of an additional cost when setting up the agreement, presented as the initial charge, as well as having a limited time offer on the actual subscription.

In addition to campaigns and initial charges being available as individual flows, they can also be combined. In this case, the user would see first a summary of both the agreement, including the campaign as described in the sections on campaigns, as well as the initial charge. Again, all fields described in previous flows are available for the merchant to display information to the user.

Agreement screens with initial and campaign

Agreement lifecycle management

Drafting multiple agreements

Merchants can draft multiple agreements for the same user in scenarios where:

- The user subscribes to multiple services from the same merchant.

- A single individual manages subscriptions for others (e.g., family, relationships, guardianship).

However, it is the merchant's responsibility to track and manage these drafts to avoid unnecessary duplication. If drafting multiple agreements is not desirable, you must ensure that:

- Each draft is linked to a specific user.

- No duplicate drafts exist for users who already have an agreement in the

PENDINGstate.

Preventing duplicate drafts

To prevent duplicate drafts:

- Check existing agreements: Before creating a new draft, use the

GET:/recurring/v3/agreementsendpoint to verify if the user already has aPENDINGagreement. - Inform the user: If a

PENDINGagreement exists, notify the user to complete the activation in the Vipps or MobilePay app or the provided landing page. - Handle stuck agreements: If an agreement remains

PENDINGdue to process failures:- Allow the user to draft a new agreement, if necessary.

- Track "abandoned" agreements to manage them later (e.g., stop them or issue refunds if activated undesirably).

User-initiated agreement cancellations

MobilePay App: Users can cancel their payment agreements directly through the app.

MobilePay App: Users can cancel their payment agreements directly through the app. Vipps App (After 2024-11-05): Most agreements can be canceled within the Vipps app. Merchants who have opted out of the "Stop agreement" feature will direct users to their "My Page" link, displayed in the app's Manage Agreement screen.

Vipps App (After 2024-11-05): Most agreements can be canceled within the Vipps app. Merchants who have opted out of the "Stop agreement" feature will direct users to their "My Page" link, displayed in the app's Manage Agreement screen.

Merchant-initiated agreement deletions

Merchants can Stop an agreement by using the PATCH:/recurring/v3/agreements/{agreementId} endpoint. This action updates the agreement status to STOPPED.

Impact of agreement cancellation on charges

When an agreement is stopped:

- All charges in

PENDING,DUE, orRESERVEDstates are automatically canceled.- Exception: Charges with the

RESERVEDstatus are not canceled if the user initiates the agreement cancellation.

- Exception: Charges with the

- Initial Charges: Ensure any initial charges are processed before stopping the agreement, as

RESERVEDinitial charges will also be canceled.

Intervals

The interval defines how often the user will be charged.

When the charges on the agreement follow a particular frequency, set the interval unit YEAR, MONTH, WEEK, or DAY and frequency as a count. The count can be any number between 1 and 31.

Example for a bi-weekly subscription:

{

"interval": {

"unit": "WEEK",

"count": 2

}

}

Users can be charged the full amount every two weeks, regardless of the day in the week. (E.g. First charge can be due on Wednesday of week 1 and the second charge can be due on Monday of week 3).

Example for a quarterly subscription

{

"interval": {

"unit": "MONTH",

"count": 3

}

}

Users can be charged the full amount every third month, regardless of the day in the month. (E.g. First charge can be due on 2023-01-05 and second on 2023-04-02)

Examples for a yearly subscription

{

"interval": {

"unit": "YEAR",

"count": 1

}

}

OR

{

"interval": {

"unit": "MONTH",

"count": 12

}

}

Users can be charged the full amount once every year, regardless of the day in the year. (E.g. First charge can be due on 2022-06-02 and second charge on any day in 2023, for example on 2023-01-01)

Example for a subscription every 30th day:

{

"interval": {

"unit": "DAY",

"count": 30

}

}

Users can be charged the full amount once every 30 days, regardless of the day in the month. (E.g. First charge can be due on 2022-06-12 and second charge on 2022-07-04)

For the pay-per-use pricing model, where the charges on the agreement have no periodicity, the interval field must be omitted. For example, a user can subscribe to an agreement for e-scooter rental, where the user is charged every time they rent a scooter, without any interval involved.

Example for a pay-as-you-use subscription:

{

"pricing": {

"type": "VARIABLE",

"suggestedMaxAmount": 3000,

"currency": "NOK"

},

"merchantRedirectUrl": "https://example.com/redirect",

"merchantAgreementUrl": "https://example.com/agreement",

"phoneNumber": "4712345678",

"productName": "My e-scooter Rental"

}

Change interval

It is possible to change the charge interval. Below are two examples of update interval requests :

Update request for changing the interval from RECURRING to FLEXIBLE:

{

"interval": {

"type": "FLEXIBLE"

}

}

Update request for changing the period of the interval:

{

"interval": {

"type": "RECURRING",

"period": {

"count": 1,

"unit": "MONTH"

}

}

}

See:

PATCH:/recurring/v3/agreements/{agreementId}.

Pricing representation

For Recurring, there are three pricing options when creating agreements:

LEGACY- The default type. With this, thepricing.amountparameter should represent the price that the user will pay every period.VARIABLE- You no longer specify a price but asuggestedMaxAmountfor the user.FLEXIBLE- There is no set maximum limit for the price of the product or service, and no amount needs to be specified.

Overview of pricing.type options

| Pricing Type | Displayed in App | Interval Text Shown? | Who sets amount | Pros | Cons |

|---|---|---|---|---|---|

LEGACY | e.g. "Every month" + fixed price | ✅ Yes | Merchant | • Simple setup • Clear UX for users | • Limited flexibility due to 5x charge limit |

VARIABLE | Shows "Variable" + interval (e.g. Monthly contribution) | ✅ Yes (if interval is included) | Merchant suggests max, user confirms | • Flexible pricing • User chooses max amount | • App highlights the "Variable" label • No campaigns supported |

FLEXIBLE | Shows "Variable" (interval if specified) | ✅ Yes (if interval is included) | Merchant | • Total freedom to define the charge amount | • Risk of overcharging • No user price context • No campaigns supported |

Legacy pricing

Available for Vipps and MobilePay.

Available for Vipps and MobilePay.

LEGACY is the default type.

pricing.amount should represent the price that the user will pay every period.

The amount of a charge is flexible and does not have to match the price of the agreement.

A limit is in place however, which is 5 times the agreement price.

For example, the agreement below has price of 1000 NOK. The maximum allowed charge would be 5000 NOK. If this limit becomes a

hindrance the agreement price can be updated. Although there is technically no limit to what you can update the price to, we strongly recommend that you are as user-friendly as possible.

Make sure the user understands any changes and is provided with updated information.

Here is a truncated example of request body for the POST:/recurring/v3/agreements endpoint:

{

"pricing": {

"type": "LEGACY",

"amount": 100000,

"currency": "NOK"

},

"interval": {

"unit" : "MONTH",

"count": 1

},

"...": "..."

}

Variable amount pricing

Available for Vipps and MobilePay.

Available for Vipps and MobilePay.

Recurring with variable amounts offer merchants a way to charge users a different amount each payment, as long as the amount is lower than the user's specified max amount.

This provides clarity for the customer and ensures that they know the maximum price they will have to pay for the product or service.

To create a variable amount agreement, use the VARIABLE type in Pricing.

With VARIABLE pricing, you no longer specify a price, but a suggestedMaxAmount for the user.

This field should be set to what the maximum price could be each payment.

This suggestedMaxAmount is presented to the user together with a list of auto generated amount suggestions that is created by Vipps MobilePay.

The suggestedMaxAmount is however pre-selected for the user.

The user chooses a max amount themselves when accepting the agreement, but we

recommended the user to choose the same amount as suggestedMaxAmount. The max

amount can at any time be changed by the user. What the user has picked as their

max amount will be available in the GET agreement response. Its recommended

that when you set the suggestedMaxAmount, that you set a realistic amount -

as setting it to unrealistic amounts might scare off the user when they accept

the agreement.

See the How Recurring works with variable amount for details.

Here is a truncated example of request body for the POST:/recurring/v3/agreements endpoint:

{

"pricing": {

"suggestedMaxAmount": 200000,

"currency": "NOK",

"type": "VARIABLE"

},

"interval": {

"unit" : "MONTH",

"count": 1

},

"...": "..."

}

Restrictions when using variable amount

-

There are limits for each currency for the

suggestedMaxAmount:- NOK: 20 000 kr

- DKK: 300 000 kr

- EUR: 2 000 Euro

-

Campaigncan't be used when the agreement hasvariableAmount.

In the Vipps MobilePay app, users can review the variable agreement and adjust the maximum amount that can be charged each interval. See the How Recurring works with variable amount for details.

Please note: The auto generated list is based on the suggestedMaxAmount and can't be changed by the merchant individually.

It will however change if suggestedMaxAmount changes, which can be done in the PATCH agreement endpoint.

Retrieving the agreement shows the maxAmount picked by the user

GET:/recurring/v3/agreements/{agreementId} response:

{

"id": "agr_Yv2zYk3",

"start": "2021-06-18T19:56:22Z",

"stop": null,

"status": "ACTIVE",

"productName": "Power company A",

"pricing": {

"type": "VARIABLE",

"suggestedMaxAmount": 500000,

"maxAmount": 1800000,

"currency": "NOK"

},

"productDescription": "Access to subscription",

"interval": {

"unit": "MONTH",

"count": 1,

"text": "hver måned"

},

"campaign": null,

"sub": null,

"userinfoUrl": null

}

Change suggestedMaxAmount

It's possible to change the suggestedMaxAmount on the agreement by calling the update agreement endpoint with the PATCH:/recurring/v3/agreements/{agreementId} request below.

{

"suggestedMaxAmount": 300000

}

Please note: The user will not be alerted by this change.

Create charge

The amount of the charge/charges in the interval can't be higher than the suggestedMaxAmount or maxAmount field, depending on which is highest.

Examples:

- If

suggestedMaxAmountis set to 5000 kr andmaxAmountchosen by the user is 2000 kr, then the charge amount can't be higher than 5000 kr - If

suggestedMaxAmountis set to 5000 kr andmaxAmountchosen by the user is 7000 kr, then the charge amount can't be higher than 7000 kr

Charge amount higher than the user's max amount

If the amount of a charge is below (or equal) the suggestMaxAmount but above the user's maxAmount, the charge will be set

to DUE and the user will be notified and encouraged to alter the max amount to a higher amount.

If the user does not update their maxAmount to the same or a higher amount than the charge, it will fail when due + retryDays is reached, and

the status will be FAILED.

The user will also see a failure description on the charge in the Vipps or MobilePay app.

See the How Recurring works with variable amount for details.

Flexible pricing

Available for Vipps and MobilePay.

Available for Vipps and MobilePay.

There is no set maximum limit for the price of product or service. This pricing leaves room for flexibility and is recommended if the customer pays a varied amount. For example, an electricity provider charges a varied amount, dependent on the customer's usage of electricity.

Here is a truncated example of request body for the POST:/recurring/v3/agreements endpoint:

{

"pricing": {

"type": "FLEXIBLE",

"currency": "DKK"

},

"interval": {

"unit" : "MONTH",

"count": 1

},

"...": "..."

}

Initial charge

Please note: If the subscription is cheaper in the beginning than the normal price later, use

campaigns in combination with initial charge.

If you use initialcharge alone for campaigns, users will be confused by how it appears in Vipps MobilePay,

as it looks like the full price period starts immediately.

Initial charge will be performed if the initialcharge is provided when

creating an agreement. If there is no initial charge, don't send initialcharge

when creating the new agreement.

Unlike regular (or RECURRING) charges, there is no price limit on an initialCharge.

This allows for products to be bundled with agreements as one transaction

(for example, a phone). The user will be clearly informed when an initialCharge

is included in the agreement they are accepting.

See Charge Titles for explanation of how the charge description is shown to the user.

The initial charge has two forms of transaction, DIRECT_CAPTURE and RESERVE_CAPTURE.

DIRECT_CAPTURE processes the payment immediately, while RESERVE_CAPTURE

reserves the payment for capturing at a later date. See:

Knowledge base: Reserve capture vs. direct capture

in the FAQ.

RESERVE_CAPTURE must be

used when selling physical goods bundled with an agreement - such as a phone

when subscribing to an agreement.

This example shows the same agreement as above, with an initialCharge

of 499 NOK:

{

"phoneNumber": "4712345678",

"initialCharge": {

"amount": 49900,

"description": "Premier League subscription",

"transactionType": "DIRECT_CAPTURE"

},

"interval": {

"unit" : "MONTH",

"count": 1

},

"merchantRedirectUrl": "https://example.com/confirmation",

"merchantAgreementUrl": "https://example.com/my-customer-agreement",

"pricing": {

"amount": 49900,

"currency": "NOK"

},

"productDescription": "Access to all games of English top football",

"productName": "Premier League subscription"

}

Change the transactionType field to RESERVE_CAPTURE to reserve the initial charge.

{

"initialCharge": {

"transactionType": "RESERVE_CAPTURE",

"amount": 19900,

"description": "Phone"

}

}

A reserved charge can be captured with the

POST:/recurring/v3/agreements/{agreementId}/charges/{chargeId}/capture endpoint

when the product is shipped.

Landing page

Agreement status when cancelling on the landing page

Once the user clicks confirm and start or pay and start in the Vipps/MobilePay app, the agreement will be ACTIVE. However, if they click cancel the payment on the landing page before confirming in the app, the agreement will be STOPPED.

If the user has confirmed the agreement in the app and then clicks cancel on the landing page while the spinner is still active, the agreement might inadvertently be set to the ACTIVE state.

Merchants are responsible for handling this scenario. After redirection, merchants can:

- Cancel the agreement manually.

- Prompt the user to check their Vipps or MobilePay app to complete the agreement.

Restricting agreement acceptance to specific users

Merchants can restrict agreements to specific users by fixing a mobile number in the landing page input field. This requires the following:

- The merchant must know the user's mobile number.

- The number must be included in the create agreement request.

- Vipps MobilePay must configure

no_edit_landingpagefor the merchant's sales unit.

Merchants should contact their Key Account Manager (KAM) to enable this feature.

Skip landing page

This functionality is only available for special cases.

See: Landing page

If the skipLandingPage property is set to true in the

POST:/recurring/v3/agreements

call, it will cause a push notification to be sent to the given phone number

immediately, without loading the landing page.

If the sales unit is not whitelisted, the request will fail and an error message will be returned.

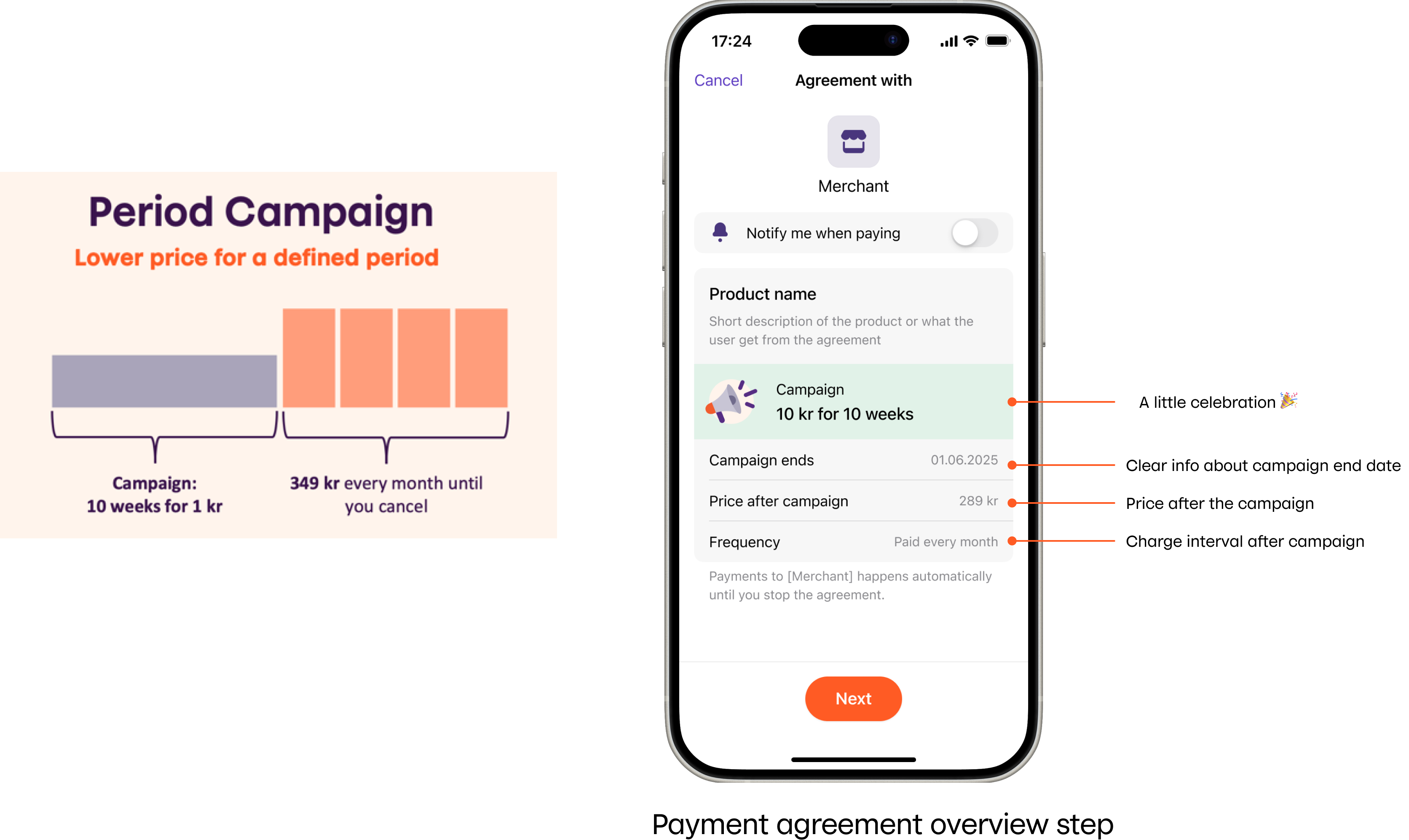

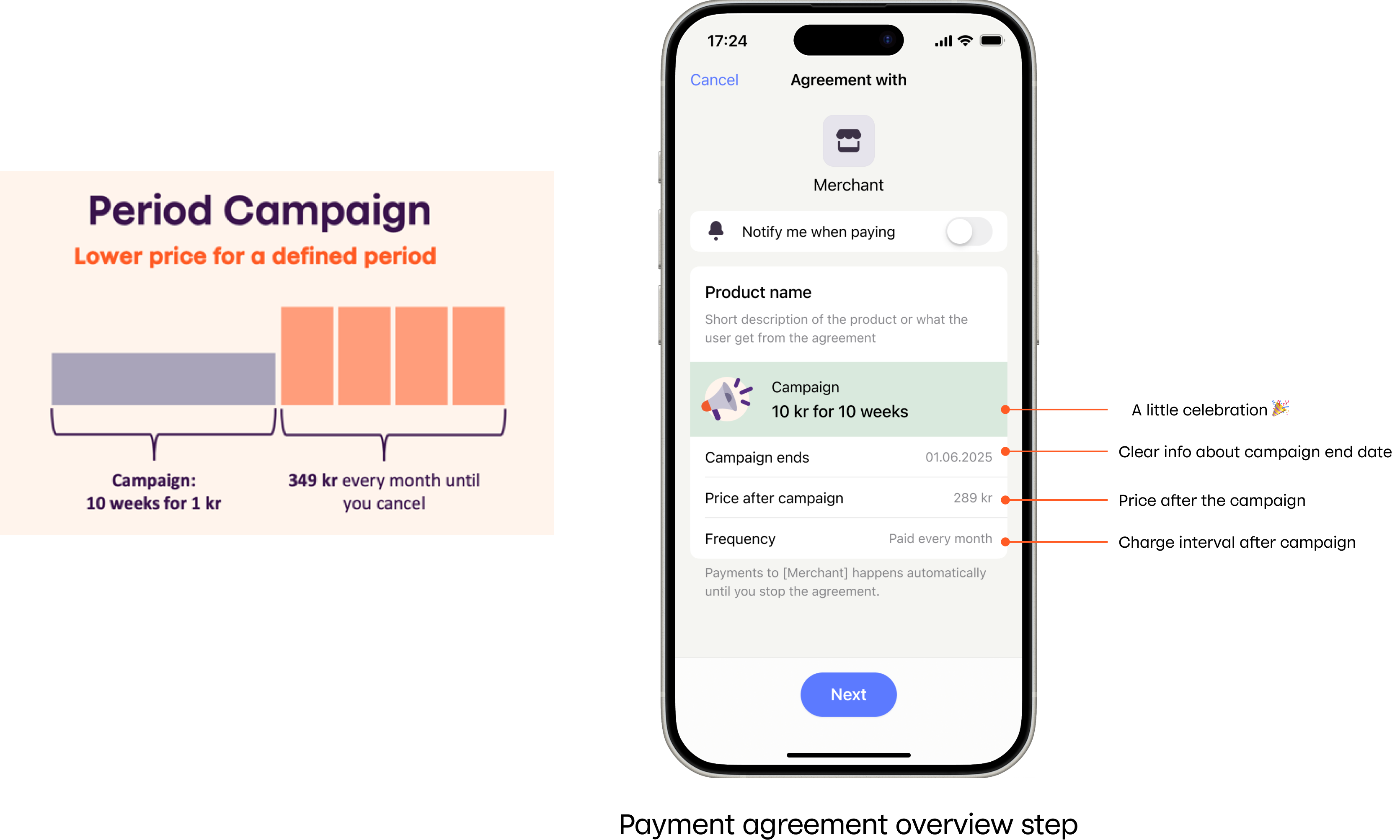

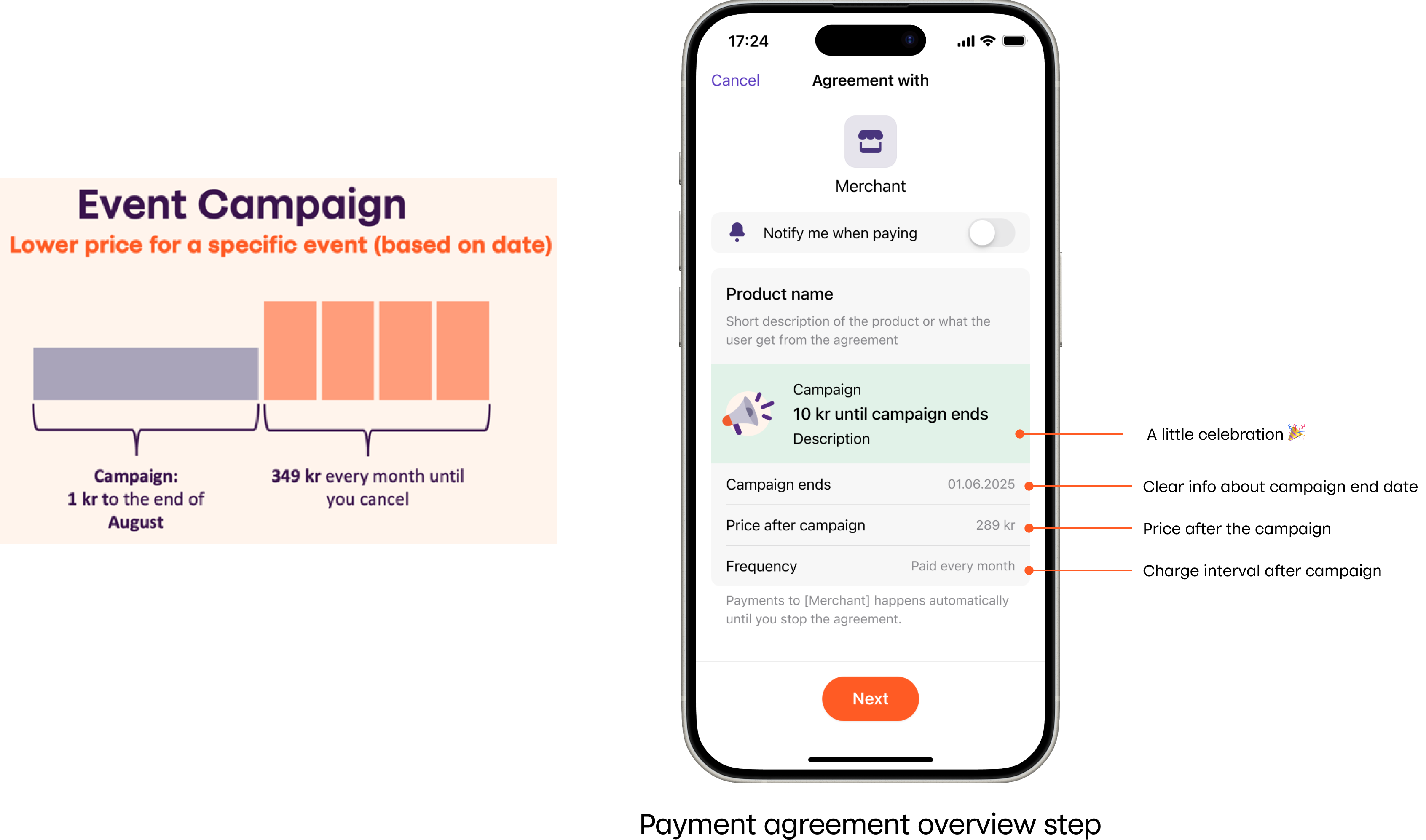

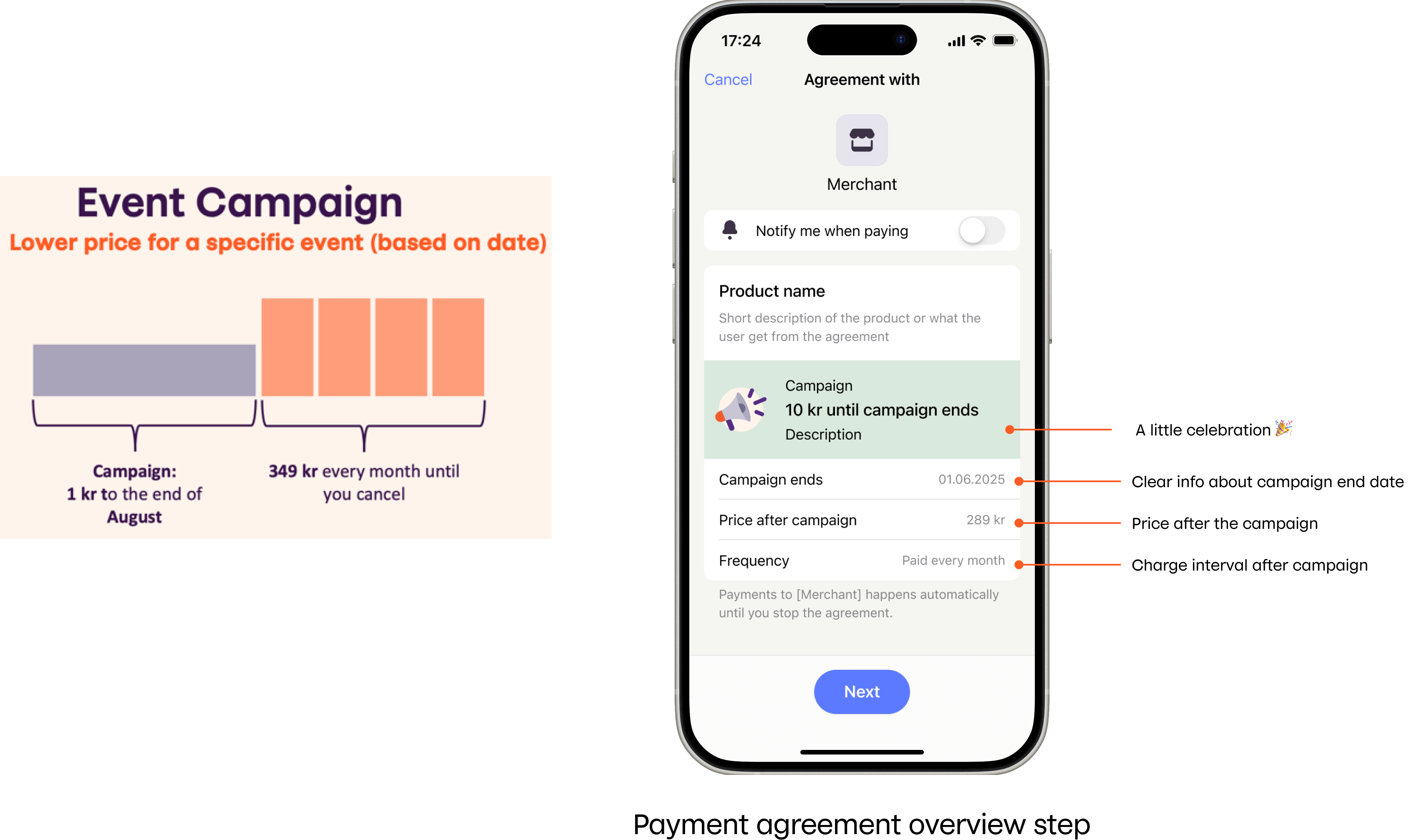

Campaigns

A campaign in Recurring is a period where the price is lower than usual, and this is communicated to the customer with the original price shown for comparison. Campaigns cannot be used in combination with variable amount.

Types of campaigns

There are 3 different campaign types: price campaign, period campaign, and event campaign.

See more about the different campaign types in the table below.

| Campaign types | Description | Example |

|---|---|---|

price campaign | Different interval price until specified date. Same interval as agreement. | 1kr every week until 2022-12-25T00:00:00Z and then 50kr every week |

period campaign | A set price for a given duration. A duration is defined by a number of periods (DAY, WEEK, MONTH, YEAR) | 10 weeks for 1kr and then 349kr every month |

event campaign | A set price until a given event date with a text describing the event | 1kr until Christmas and then 349kr every month |

In order to start a campaign, the campaign field has to be added to the agreement draft body in the

POST:/recurring/v3/agreements call.

Price campaign

- Vipps

- MobilePay

{

"campaign": {

"type": "PRICE_CAMPAIGN",

"end": "2022-12-25T00:00:00Z",

"price": 100

}

}

| Field | Description |

|---|---|

type | The type of the campaign |

price | The price that the customer will pay for each interval during the campaign |

end | The end date of the campaign |

Period campaign

- Vipps

- MobilePay

{

"campaign": {

"type": "PERIOD_CAMPAIGN",

"price": 100,

"period": {

"unit": "WEEK",

"count": 10

}

}

}

| Field | Description |

|---|---|

type | The type of the campaign |

price | The price that the customer will pay for the period of the campaign |

period | The period where the campaign price is applied. Consists of a Unit and a Count, for example: { "unit": "MONTH", "count": 1 } |

Event campaign

- Vipps

- MobilePay

{

"campaign": {

"type": "EVENT_CAMPAIGN",

"price": 100,

"eventDate": "2022-09-01T00:00:00Z",

"eventText": "until Christmas"

}

}

| Field | Description |

|---|---|

type | The type of the campaign |

price | The price that the customer will pay until the event date |

eventDate | The date of the event marking the end of the campaign |

eventText | The event text to display to the end user |

Please note: We recommend starting the event text with lowercase for better user experience. See example below.

Charges

How charges work

- An agreement includes payments called charges.

- Charges are not created automatically based on the agreement. The merchant is responsible for creating each charge.

Key points about charges

-

Creating Charges:

- A charge is created by the merchant.

- We attempt to charge the customer starting on the

duedate, and will retry based on theretryDaysspecified. - Charges can only be created if the agreement status is

ACTIVE. They cannot be created if the agreement is in any other status (e.g.,PENDING,STOPPED). - A charge amount can be different from the agreement price

- See For how long is a payment reserved.

-

Payment handling:

- We handle all payment details. Merchants do not need to store or manage card data.

-

Charging limits:

- Within the

intervalperiod of the agreement, the merchant can charge up to 5 times the agreement price cumulatively. - There is no limit on the number of charges that can be sent during the

intervalperiod.

- Within the

-

Price changes:

- If the agreement price changes, it is recommended to update the agreement's pricing.

- For more significant price changes, creating a new agreement is advised.

-

Merchant responsibility:

- Merchants are responsible for ensuring that the user is informed and understands the price of the agreement.

-

Push notifications:

- We always send a push notification to the user in the app if a charge attempt is unsuccessful.

- The user will see more detailed information about the charge and agreement in the app.

- We don't send any SMS. We only send the push message in Vipps/MobilePay app

-

User interaction:

- Merchants should always ask the user to check the status of charges in the app.

- We are unable to manually check charges unless there is a clear indication of an error on our end.

-

Cancelling pending payments:

- Users cannot directly cancel pending payments. However, they can cancel the agreement, which will cancel any pending payments associated with the agreement.

-

Charge visibility in the app:

- Charges are visible to the user in the app once they transition to the

DUEstate. - A charge remains in the

PENDINGstate until theduedate is within 30 days. - Merchants can retrieve all relevant charges using the

GET:/recurring/v3/agreements/{agreementId}/chargesendpoint.

- Charges are visible to the user in the app once they transition to the

-

Payment card management:

- The user is responsible for keeping their payment cards updated.

- If a payment fails, the user will receive a push notification informing them to update their card.

- We do not automatically select a new card if a card expires, as users may have multiple cards registered in the app. Additionally, there are regulatory requirements: The user must actively choose a card.

- We automatically send the user a push notification when a card that is not used for recurring payments expires

Charges When an agreement is canceled

If the agreement is stopped, all charges in a PENDING, DUE, or RESERVED state will be canceled.

Note: This includes the initial charge if it is in the RESERVED state. If the merchant needs to charge the user for the initial charge, it must be done before the agreement is stopped.

Note: Charges with the RESERVED status will not be canceled if the agreement is stopped by the user.

Charge visible

The charge will be visible to the user in the app when it goes into the DUE state.

A charge will remain in PENDING state until the due date is less than 30 days away.

You can retrieve all relevant charges through the

GET:/recurring/v3/agreements/{agreementId}/charges endpoint.

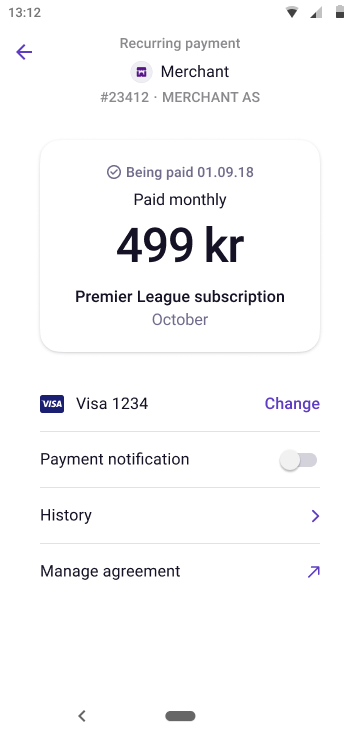

Charge descriptions

When charges are shown to users in the app, they will have a title, and a

description. The title of a charge is derived directly from

{agreement.productName} whereas the description is set per charge, i.e.

{charge.description}. For example, a charge on an agreement with product

name "Premier League subscription" with description "October" would look like

the following screenshot:

When the charge is completed (the money has been moved), the payment will

show up in the users' payment history. There, a charge from

Vipps MobilePay recurring payments will have a description with follow format

{agreement.ProductName} - {charge.description}.

This is an example of a request body for the POST:/recurring/v3/agreements/{agreementId}/charges call:

{

"amount": 49900,

"transactionType": "DIRECT_CAPTURE",

"description": "October",

"due": "2018-09-01",

"retryDays": 5

}

Please note: description cannot be longer than 45 characters.

Charge type

There are two types available for a charge. RECURRING and UNSCHEDULED.

If charge type is not specified on charge creation, type defaults to RECURRING.

Recurring charge

A recurring charge is a payment that is set up to occur on a specific due date. The charge will be processed at the due date, and retries are attempted according to the number of retryDays specified.

We recommend using this type of charge for pre-planned payments that occur on a regular schedule (based on the agreement interval).

Extended Benefits of using chargeType: RECURRING

When using chargeType: RECURRING, we handle retries and customer communication natively within the app. This can lead to better payment success rates and a smoother experience for both customers and support teams.

Key benefits include

- Automatic retries: Payments are retried for up to

retryDays, without merchant intervention - In-app notifications: Users are notified directly in Vipps or MobilePay, ensuring visibility and reducing the need for email/SMS reminders

- Higher conversion: Fewer failed payments due to immediate retry logic and automatic reminders

- Simplified logic: Less custom logic required on the merchant side to handle retries and failure states

{

"amount": 49900,

"transactionType": "DIRECT_CAPTURE",

"description": "October",

"due": "2018-09-01",

"retryDays": 5,

"type": "RECURRING"

}

Unscheduled charge

To be able to create UNSCHEDULED charges, ask to be added to the allow list. Please email us at

developer@vippsmobilepay.com

(or use your Slack channel if you have one) and include all the following information:

- Merchant serial number which needs to be added to the allow list

- A detailed summary of the user journey where you will use unscheduled charge. We will review the summary and add the merchant serial number to the allow list

If your integrations are handled by a partner, also remember to check with them on whether they support unscheduled charges.

An unscheduled charge is sporadic or one-time payment that do not follow a set schedule.

We recommend using this type of charge for a one-time purchase or a one-time service fee in relation to the agreement.

Unscheduled charge will be processed asynchronously after creation. It supports both the transaction types, DIRECT_CAPTURE and RESERVE_CAPTURE. If the charge is successful, recurring.charge-reserved or recurring.charge.captured event is sent (depending on the transaction type of the charge).

If the charge fails for any reason, recurring.charge.failed event will be sent and the user is notified with an in-app notification that the charge failed.

Please note: When unscheduled charges fail, we do not retry. It is the merchant or partner's responsibility to retry the unscheduled charges.

{

"amount": 49900,

"transactionType": "DIRECT_CAPTURE",

"description": "October",

"type": "UNSCHEDULED"

}

If the sales unit is not approved for 'UNSCHEDULED' charges the charges will fail with:

"title": "Charge not creatable",

"status": 400,

"detail": "Cannot create a charge with type 'UNSCHEDULED'"

Due date

due will define for which date a recurring charge will be performed.

This date has to be minimum 1 day in the future (and maximum two years in advance), so the user is able to see the upcoming charge in the Vipps or MobilePay app. This enables to user to make sure funds are available, or in other ways make sure that the charge is paid in time - increasing the success rate.

Users will see upcoming charges up to 35 days before the due date under the Payments tab

in the Vipps or MobilePay app.

Example: If the charge should be performed on the 27th, it must be created on the 26th, or earlier. The user is only shown one charge per agreement, in order to not overwhelm the user when doing daily or weekly charges.

In the

test environment

it's possible to create charges just one day before due.

See:

- FAQ: Are users notified of every charge?

- FAQ: Is there a delay for charges?

- FAQ: Does the user have to confirm each payment?

Transaction type

A charge has two forms of transaction, DIRECT_CAPTURE and RESERVE_CAPTURE.

Please note: RESERVE_CAPTURE transaction type is only available in the V3 API.

DIRECT_CAPTURE processes the payment immediately, while RESERVE_CAPTURE

reserves the payment for capturing at a later date. See

Knowledge base: Reserve capture vs. direct capture

in the FAQ for more details.

RESERVE_CAPTURE must be used when selling physical goods or a need to provide access at a later point.

The advantage to using reserve capture is that you can release the reservation immediately:

- For a reserved payment, the merchant can make a /cancel call to immediately release the reservation and make it available in the customer's account.

- For a captured payment, the merchant must make a /refund call. It then takes a few days before the amount is available in the customer's account.

Creating single or multiple charges

Create a charge

To create a charge use the POST:/recurring/v3/agreements/{agreementId}/charges endpoint.

For agreements with VARIABLE_AMOUNT pricing, see Recurring agreements with variable amount.

Create multiple charges

To create multiple charges with single request use the POST:/recurring/v3/agreements/charges endpoint.

It is possible to create up to 2 000 charges in a single request.

We validate charges in two steps. First, we check them at the API level, and any failed charges are returned in the API response. Then, we schedule asynchronous creation, where charges are validated against different criteria. If a charge doesn't pass this validation, a webhook is sent with the event type "recurring.charge-creation-failed.v1." Learn more about Recurring API Webhooks integration.

Full and partial capture

Capture a charge

Capture payment allows the merchant to capture the reserved amount of a charge. The API allows for both a full amount capture and a partial amount capture (V3 API only)

The amount to capture cannot be higher than the reserved amount.

The description text is mandatory and is displayed to the end user in the Vipps or MobilePay app.

Capture is done with the POST:/recurring/v3/agreements/{agreementId}/charges/{chargeId}/capture endpoint.

Please note: It is important to check the response of the /capture call.

The capture is only successful when the response is HTTP 204 No Content.

Do not capture before the product or service is provided to the customer, as per the capture regulations.

If it's not captured within the payment capture deadlines, it will be automatically cancelled.

Partial capture

Limited availability for MobilePay. You must inquire during onboarding or

contact customer service.

Limited availability for MobilePay. You must inquire during onboarding or

contact customer service.

V3 API only: Partial capture may be used in cases where a partial order is shipped or for other reasons. Partial capture can be called as many times as required while remaining reserved amount is available.

If one or more partial capture have been made, any remaining reserved amount will be automatically released after a few days. See FAQ: For how long is a payment reserved for more details.

If you cancel a charge that is PARTIALLY_CAPTURED, the remaining funds on the charge will be released back to the customer

and the charge status will be set to CHARGED.

Retrieve a charge

To retrieve a charge, we recommend using the GET:/recurring/v3/agreements/{agreementId}/charges/{chargeId} endpoint.

You can also look up an agreementId if you have the chargeId.

Please note: The endpoint GET:/recurring/v3/charges/{chargeId} is not intended for automation.

There is a stricter rate limiting (See Rate limiting) on this endpoint because it is more expensive to fetch a charge without the agreementId.

Its purpose is to simplify investigations when the merchant lost track of which charge belongs to which agreement.

It should not be used as a substitute for the GET:/recurring/v3/agreements/{agreementId}/charges/{chargeId} endpoint.

Details on charges

The response from the GET:/recurring/v3/agreements/{agreementId}/charges/{chargeId} endpoint

contains the history of the charge and not just the current status.

It also contains a summary of the total of amounts captured, refunded and cancelled.

Truncated example of the response from the GET:/recurring/v3/agreements/{agreementId}/charges/{chargeId} endpoint:

{

"id": "chr_WCVbcA",

"status": "REFUNDED",

"amount": 1000,

"type": "RECURRING",

"transactionType": "RESERVE_CAPTURE",

"...": "...",

"summary": {

"captured": 1000,

"refunded": 600,

"cancelled": 0

},

"history": [

{

"occurred": "2022-09-14T10:31:15Z",

"event": "CREATE",

"amount": 1000,

"idempotencyKey": "e80bd8c6-3b83-4583-a49c-847021fcd839",

"success": true

},

{

"occurred": "2022-09-16T06:01:00Z",

"event": "RESERVE",

"amount": 1000,

"idempotencyKey": "chr-4assY8f-agr_FJw2Anb-ProcessPayment",

"success": true

},

{

"occurred": "2022-09-18T06:01:00Z",

"event": "CAPTURE",

"amount": 1000,

"idempotencyKey": "096b1415-2c77-4001-9576-531a856bbaf4",

"success": true

},

{

"occurred": "2022-09-20T06:01:00Z",

"event": "REFUND",

"amount": 600,

"idempotencyKey": "0bc7cc3b-fdef-4d24-b4fe-49b7da40d22f",

"success": true

}

]

}

List charges

All charges, including the optional initial charge, for an agreement can be retrieved with the

GET:/recurring/v3/agreements/{agreementId}/charges endpoint.

Cancel a charge

You can cancel charges that are in the PENDING, DUE or RESERVED state.

If you cancel a charge that is PARTIALLY_CAPTURED, the remaining funds on the charge will be released back to the customer

and the charge status will be set to CHARGED.

Please note: If you cancel an agreement, there is no need to cancel the charges that belong to the agreement. We will do this automatically for you.

A charge can be cancelled with the

POST:/recurring/v3/agreements/{agreementId}/charges/{chargeId}

endpoint.

Refund a charge

A charge can be refunded with the

POST:/recurring/v3/agreements/{agreementId}/charges/{chargeId}/refund

endpoint.

Refunds must always be done using the API, through the merchant's administration solution.

From the API checklist:

Make sure your customer support have all the tools and information they need available in your system, through the APIs listed in the first item in this checklist, and that they do not need to visit portal.vippsmobilepay.com for normal work.

Merchants can also refund recurring charges directly on the business portal. This will update the information provided through the API and send a webhook event.

Charge attempts

Charge attempts are made according to the payment batches schedule mentioned below.

We may do extra attempts and/or change this without notice.

The time taken to process all due charges may vary each day, and we do not guarantee any time.

Subsequent attempts are made according to the retryDays specified.

When a charge has reached its due date, the status of the charge will be

DUE until the charge is successful, for as long as the merchant has

specified with retryDays. In other words, there will be no status updates

while we are attempting to charge.

Important: We do not "leak" the customers' information about insufficient funds, blocked cards, or other problems. Users are informed about all such problems in the Vipps or MobilePay app, which is the only place they can be corrected. The merchant's customer service should always ask the user to check in the app if a charge has failed.

Please note: This is the same both for our production and test environment. Payments might get processed any time during the day due to special circumstances requiring it.

Please note: Since payments can be processed any time during the due date it is advisable to fetch the charge at/after 00:00 UTC the day after the last retry day to be sure you get the last status.

Payment batches schedule

We strongly recommend that merchants do not rely on the batch timings when designing their systems.

Due to various reasons, both internal and external to Vipps MobilePay, we cannot guarantee when the batches will be executed.

The batch timings for each market are in their respective local time zones.

For Norwegian agreements

- 09:00: Biggest batch with new charges

- 17:00: Retry batch

For Finnish agreements

- 03:00: Biggest batch with new charges

- 13:00, 18:00, 20:00, 22:00, and 23:00: Retry batches

For Danish agreements

- 03:00: Biggest batch with new charges

- 13:00, 18:00, 20:00, 22:00, and 23:00: Retry batches

Charge retries

To prevent a charge from failing permanently after an initial transaction failure (e.g., due to insufficient funds or network issues), use the retryDays field.

If a charge fails on due date the charge will be retried for the number of days specified in the retryDays field, with a maximum limit of 14 days.

We don't provide details about each charge attempt to the merchant, but we do help the user to correct any problems in the Vipps or MobilePay app. This results in a very high success rate for charges. This means that if the user's card has insufficient funds, the card has expired, the card is invalid, etc. the user is notified and can correct the problem.

The status of a charge will be DUE while we are taking care of business,

from the due date until the charge has succeeded, or until the

retryDays have passed without a successful charge.

The final status will be CHARGED or FAILED.

For the highest success rate we strongly recommend at least two days retry: retryDays: 2.

Example:

If due date is set to January 1st and retryDays is set to 2 we will attempt to complete the charge for a total of 3 days.

- Due date: January 1st

- 1st retry day: January 2nd

- 2nd retry day: January 3rd

The retryDays are not tied to the agreement's interval. This means that a charge

can be retried for a maximum of 14 days even though the next interval has started.

For example, an agreement with daily interval can have a charge retried for

multiple days, and it is possible to create new daily charges while others are

still retrying.

See:

orderId and externalId

The orderId and externalId fields provide flexibility in charge management and settlement reporting.

orderId

- Overrides the automatically generated

chargeIdwhen specified. - Used for all subsequent charge identification and in settlement reports (unless

externalIdis specified). - Requirements:

- Must be unique across all Recurring and eCom transactions for the given

merchantSerialNumber. - If not provided, a unique

chargeId(e.g.,chr-xxxxxxx) will be generated automatically.

- Must be unique across all Recurring and eCom transactions for the given

- For detailed recommendations, see Recommendations for

referenceandorderId.

externalId

- A flexible alternative to

orderId:- Does not override the

chargeId. - Used exclusively in settlement reports.

- Does not override the

- Does not require strict uniqueness but should be used thoughtfully to avoid settlement mismatches.

Combined usage

- If both

orderIdandexternalIdare provided:orderIdoverrideschargeIdfor charge identification.externalIdis used in settlement reports.

Example usage of orderId

An optional and recommended orderId can be set in the POST:/recurring/v3/agreements/{agreementId}/charges request:

{

"amount": 49900,

"description": "Premier League subscription",

"due": "2030-12-31",

"transactionType": "DIRECT_CAPTURE",

"retryDays": 5,

"orderId": "acmeshop123order123abc"

}

See Recommendations for reference and orderId for more details.

Charge states

This table has all the details for the charge states returned by the

GET:/recurring/v3/agreements/{agreementId}/charges/{chargeId} endpoint:

| State | Description |

|---|---|

PENDING | The charge has been created, but is not yet be visible in the Vipps or MobilePay app. |

DUE | The charge is visible in the Vipps or MobilePay app and will be processed on the due date. |

PROCESSING | The charge is being processed right now. |

CHARGED | The charge has been successfully processed, and the available amount has been captured. |

FAILED | The charge has failed because of insufficient funds, no valid cards, etc. The Vipps or MobilePay app gives the user all possible opportunities to pay, including adding a new card, but does not provide the details to the merchant. |

REFUNDED | The charge has been refunded. Refunds are allowed up to 365 days after the capture date. |

PARTIALLY_REFUNDED | Part of the captured amount has been refunded. |

RESERVED | The charge amount has been reserved, and can now be captured POST:/recurring/v3/agreements/{agreementId}/charges/{chargeId}/capture |

PARTIALLY_CAPTURED | Part of the reserved amount has been captured and the remaining amount as not been cancelled yet. If you do not plan on capturing the rest, you should cancel the remaining amount to release the funds to the customer. |

CANCELLED | The charge has been cancelled. |

IMPORTANT: We don't provide details about each charge attempt to the merchant, but we help the user to correct any problems in the Vipps or MobilePay app. This results in a very high success rate for charges.

Example charge flows

Scenario: Everything goes as it should: The user has money, and the charge is successful on the due date:

PENDING->DUE(just for the one due day)->CHARGED

Scenario: The user does not have funds and retryDays = 0:

PENDING->DUE->FAILED

Scenario: The user does not have funds on the due date, retryDays = 10, and has funds on the fifth day:

PENDING->DUE(for five days) ->CHARGED

Please note: Since charges are polled by the merchant, it is possible that

the charge status appears to "skip" a transition, e.g. moving directly from

PENDING to CHARGED, or even from PENDING to REFUNDED

depending on your systems.

Charge failure reasons

When fetching a charge through the API, you can find two fields in the response

body to identify why the charge failed failureReason and failureDescription.

For general information about payment failures (expired cards, insufficient funds, etc.) and HTTP status codes and API errors, see Troubleshooting errors.

An example from a response:

{

"status": "FAILED",

"type": "RECURRING",

"failureReason": "user_action_required",

"failureDescription": "User action required"

}

Here is a list of possible values for failureReason, their respective descriptions and possible actions that the user/merchant could take.

| Reason | Description | Explanation | Action |

|---|---|---|---|

user_action_required | User action required | Payment failed. Could be lack of funds, the customer has changed their mobile phone number, card is blocked for ecommerce, card is expired. If you want to send an email or similar to the user, you should encourage them to open the Vipps or MobilePay app and check the payment there to see why it is not paid. | User will get notified in their Vipps or MobilePay app and need to take action. This could be to add funds to the card or change the card on the agreement. Please note that it is not possible to enter an agreement without a valid payment source. |

charge_amount_too_high | Amount is higher than the users specified max amount | Amount is higher than the user's specified max amount. | The user has a lower maxAmount on the variableAmount agreement than the amount of the charge. The user must update their maxAmount on the agreement for the charge to be processed. |

non_technical_error | Non technical error | Payment failed. Could be that the user has deleted their Vipps MobilePay profile. | The user needs to take action in the app. |

technical_error | Technical error | Payment failed due to a technical error in Recurring or a downstream service. | As long as the charge is not in the status FAILED, we are retrying the payment. If the status is FAILED and the customer has not been charged by any other means, we recommend creating a new charge with a new due date. |

Processing mode

As explained in Charge retries, processing of charge payments are attempted (at least) twice a day.

It is possible to alter this behavior by setting the processingMode parameter to SINGLE_ATTEMPT,

which will cause the charge to be attempted only once before resolving to either CHARGED or FAILED.

When using SINGLE_ATTEMPT, the retryDays parameter must be set to 0.

This is an example of a request body for a recurring charge that will not be retried:

{

"amount": 49900,

"transactionType": "DIRECT_CAPTURE",

"description": "Description text",

"type": "RECURRING",

"due": "2024-02-15",

"retryDays": 0,

"processingMode": "SINGLE_ATTEMPT"

}

The default value is MULTIPLE_ATTEMPTS. The parameter can't be set for unscheduled charges.

Notifications to users for failed charges

When a charge fails, the user is notified in two ways:

-

Push Notifications:

- A push notification is sent for each failed attempt.

- Check Charge attempts for processing details.

- Note: Users may not have push notifications enabled.

-

App Messages: