Capture

Capture is the process of moving funds from the customer’s account to the merchant’s account.

Depending on your bank, this can take a few days. See Settlements for payout timing and records.

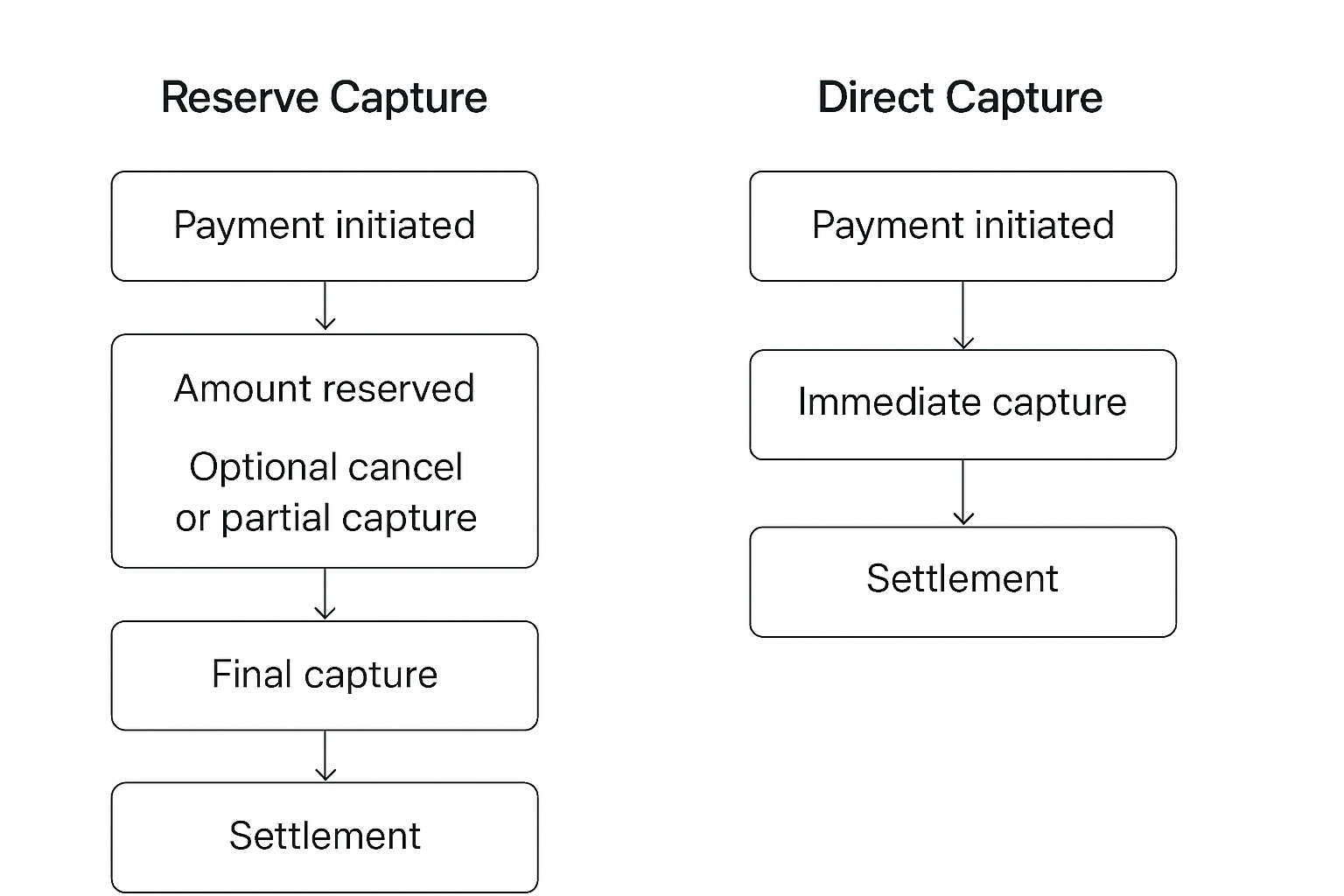

The default type of capture is Reserve capture. This is where the payment goes into the reserved state once authorized.

Direct capture is a special type of capture applicable only in the Recurring API and eCom API. In this case, the payment goes directly to the paid state and the payment is immediately captured.

As Reserve capture is the default flow, this page will relate mostly to this.

Reserve capture vs direct capture

Only the eCom API and Recurring API support direct capture.

- Reserve capture is the default. When you initiate a payment it will be reserved until you capture it. The capture can be done a few seconds later, or several days later.

- When direct capture is activated, all payment reservations will instantly be

captured. This is intended for situations where the product or service is

immediately provided to the customer, and there is no chance that the service

is not available or sold out, e.g. digital services.

Direct capture may require additional compliance checks of the merchant.

- For the eCom API, direct capture requires additional compliance checks of the merchant.

- For Recurring API, direct capture is enabled by default.

Some things to consider:

- If a payment has been reserved (as with "reserve capture"), the merchant can

make a

/cancelcall to immediately release the reservation and make available in the customer's account. - If a payment has been captured (as with "direct capture"), the merchant has to

make a

/refundcall, and it then takes several days before the amount is available in the customer's account. - With "reserve capture" it is possible to reserve a higher amount and only capture a part of it (useful for electric car charging stations, etc.). It is also possible to capture the full amount with multiple captures ("partial capture").

If you're not sure, use "reserve capture", and just do the capture right after the reserve. The user experience is exactly the same.

Reserve capture

Reserve capture is the default way to capture payments, which works for all types of payments.

In this scenario, when a user authorizes a payment, it goes into the reserved or authorized state. Once the payment is reserved, you can capture it immediately or later (within deadline).

-

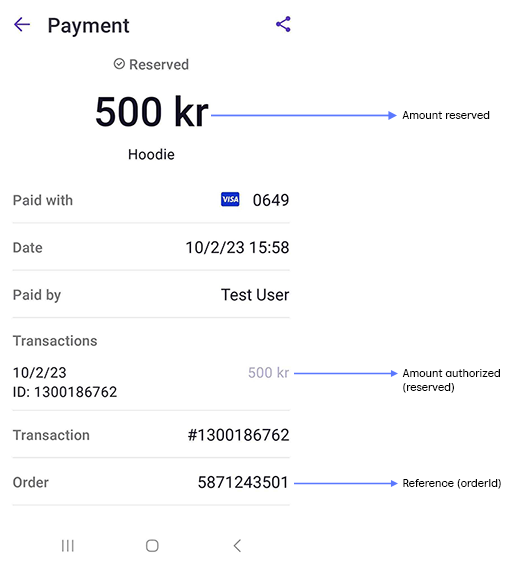

In the reserved/authorized state:

- Funds stay in the customer's account but are not available for them to spend.

- The payment details show the authorized amount in faint gray (e.g.,

500 kr).

You must capture the payment to complete the flow and receive the funds in a nightly bank transfer.

Once captured, returning funds requires a refund operation, which can also take a few days. For details about bank payouts and records, see the Settlements section.

You should capture as soon as is legally possible, because some banks will release the funds after some days, making it difficult to capture later. If it's not captured within the payment capture deadlines, it will be automatically cancelled.

However, be aware that it isn't legal to capture before the product or service is provided to the customer, as per the capture regulations.

If you do not plan to capture the entire amount, please make sure to cancel the remainder as soon as possible.

Check the response of the capture call. It is only successful when the

response is HTTP 200 OK. Attempting to capture an older payment will

result in a HTTP 400 Bad Request.

See HTTP 400 Bad Request for details.

Always use an idempotency key in the capture call because this ensures that the same request doesn't get created more than once.

With reserve capture, you have the option of capturing the full amount (full capture), or doing a partial capture, where you capture only part of the amount.

With partial capture, you can use multiple small captures until the reserved amount is used, or you could cancel any unused amount.

Partial capture

Sales units in Denmark and Finland please request this through customer service.

With partial capture, a part of the original authorized amount is captured, and the remaining amount continues to be available for capture.

Partial capture may be collected many times, for as long as there is a remaining reserved amount. You should capture or cancel the remainder when the order is complete. See Cancel a partially captured order.

Banks hold reservations for a set number of days, even with partial captures. The timer starts when the reservation is made, so be sure to complete all captures before it expires

If a payment isn't captured within the payment capture deadlines, it will be automatically cancelled. Partial captures do not extend the reservation period.

For payout timings and settlement details, see Settlements.

Example: EV charging with partial capture

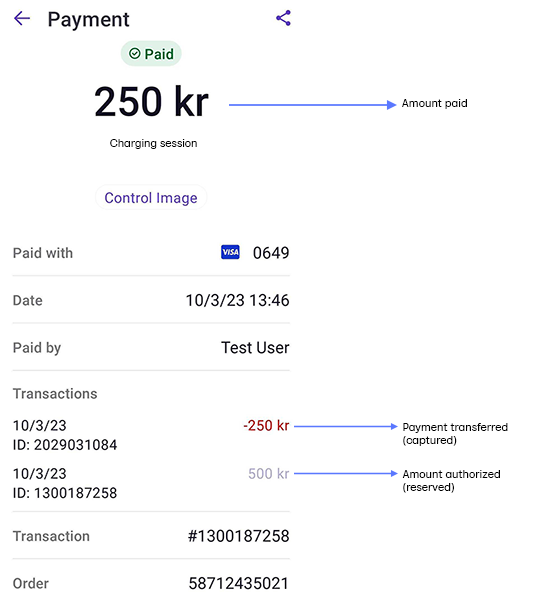

When the final amount isn’t known at the time of the payment request — for example with vending machines, charging stations, or taxis — it’s common to reserve a slightly higher (but reasonable) amount.

This ensures the payment is authorized to cover the full cost of the service. Once the exact amount is determined, the merchant captures that amount and cancels the remaining reservation.

For example:

- Customer pays at EV charger via Vipps/MobilePay.

- Merchant reserves 500 NOK (final amount unknown).

- Customer approves and charging starts.

- After charging, actual cost is 250 NOK.

- Merchant captures 250 NOK and cancels the remaining 250 NOK.

See Flows: Electric vehicle charging.

Capture regulations

According to regulations, you must not capture a payment until the product or service is provided to the customer.

We comply with local applicable laws as well as guidance from the Norwegian Data Protection Authority, Datatilsynet, and other relevant local authorities.

Capture deadlines

If payments are not captured within the below deadlines, they will be automatically cancelled.

Attempting to handle an older payment will result in a

HTTP 400 Bad Request.

See HTTP 400 Bad Request for details.

Late capture for MobilePay sales units

This is feature must be approved for your sales unit on a case-by-case basis, and it requires a legitimate need for it to run your business. The typical scenario is for online retail, where goods are delivered later (for example, when the product is not in stock), and for this reason, capture must also be done later.

Contact your KAM or customer service.

We cannot guarantee successful captures from 15 to 180 days after reservation, so there is chance of a failed capture, for example in the case of insufficient funds, expired cards, etc. See: Card payment deadlines may vary.

Credit card payment deadlines may vary

We don't control the behavior of the customer's card or account.

The information below is the most accurate we can provide, but specific details may vary.

-

VISA: Reservations usually last 5–7 days (5 days for Visa Electron). Banks release reservations after 4–7 days. If you capture within 7 days, VISA guarantees the capture will succeed.

See VISA reservations – Adyen docs. -

MasterCard: Reservations are valid for 30 days, but banks may release them earlier. If you capture within 30 days, MasterCard guarantees the capture will succeed.

See Mastercard reservations – Adyen docs.

We can't change the status of a reservation once made.

Behavior after reservation expiry

If you try to capture after 7 days (VISA) or 30 days (MasterCard)—and the bank has released the reservation—we’ll attempt a new payment. If the account has enough funds, the payment will succeed.

If the account has insufficient funds, the payment may fail or, in some cases, succeed and put the account in the negative. Whether this is allowed depends on the customer’s bank and account type.

Other factors, like expired or blocked cards, can also prevent capture, and we cannot predict these outcomes in advance.

In some cases, banks may force a capture through if possible, which could put the account in the negative. Please be aware that customers may be dissatisfied if this happens.

Attempting to capture an old payment (beyond the allowed window) will

result in HTTP 400 Bad Request.

See HTTP 400 Bad Request for details.

Troubleshooting

Why does capture fail?

The most common reasons are:

- Attempt at capturing a higher amount than the one that has been reserved: The user has approved a payment in the app, but you attempt to charge more.

- Attempt at capturing a payment that is not reserved: The user has not approved the payment.

- Attempt to capture a payment that was automatically cancelled. See payment capture deadlines.

A payment is reserved for a limited number of days before it is automatically cancelled.

All failed capture attempts get an error response from our API. The response contains the details of why the capture failed.

If the reserved amount is too low for shipping costs to be included, the capture will fail. The reserved amount must at least as high as the amount that is captured.

Example: If the value of the shopping cart is 1000 NOK, and the reserved amount is 1200 NOK, the shipping cost can be maximum 200 NOK to be within the reserved amount of 1200 NOK. If the shipping cost is 300 NOK, a capture of 1000 + 3000 NOK = 1300 NOK will fail.

It is not possible to capture more than the reserved amount, as that would make this sequence possible:

- The merchant initiates a payment of 1000 NOK

- The user confirms the 1000 NOK payment in the app

- The merchant captures 50 000 NOK from the user

Similarly: It is not possible to capture an amount that is not reserved, as that would make it possible to charge a user's card without requiring the user to confirm the payment first.

Customer reports being charged twice

Some banks display both the reservation and the capture to customers, which can lead to confusion about being charged twice. This is actually the same payment shown at different stages, not duplicate charges.

See Investigating double charge reports for detailed steps on how to investigate and explain this to customers.

Common questions

For how long is a payment reserved?

A payment is reserved until it is either captured, cancelled, or expired. For number of days, see payment capture deadlines.

When should I use "direct capture"?

Only the eCom API and Recurring API support direct capture.

If you aren't sure, you should probably use "reserve capture", and just do the capture right after the reserve. This has some benefits, see Reserve capture vs direct capture.

How can I check if I have "reserve capture" or "direct capture"?

All merchants can log in on the business portal, and check the capture type for all their sales units in the Developer section.

You can also find information on how to change capture type there. We require BankID, FTN, or MitID login for this, as "direct capture" requires additional compliance checks.

If you are a partner and want to check a merchant, see the Management API.

If you are a partner and don't yet use the Management API, you can ask the merchant to create a business portal user for you. Then, you can check on behalf of the merchant.

If you are not able to log in on the

business portal,

you can make a small payment (2 NOK), check the payment with

GET:/ecomm/v2/payments/{orderId}/details,

and cancel (if it was RESERVE and reserve capture) or refund (if it was SALE and direct capture).

How do I turn direct capture on or off?

You can't turn direct capture on or off as a merchant. A sales unit can only have one capture type, and we must configure that.

We only offer direct capture to merchants that use Vipps MobilePay through a partner, and for merchants that have a Key Account Manager. Direct capture must be requested by the partner from the partner manager, or by KAM merchants from the Key Account Manager.

See:

API guides

The following APIs have capture methods:

- ePayment API: Capture a payment

- Recurring API: Capture a charge

- eCom API (Vipps only and deprecated): Capture a payment

If you have used Checkout API to create the payment, use either the ePayment or Recurring API to reserve or capture payments.