Settlements

The settlement process will adhere to our terms and conditions.

Settlement frequency

A sales unit can be configured for daily, weekly, or monthly settlements.

- Daily - settlement is calculated at midnight, by default. Daily settlements are done every day, including bank holidays and weekends.

- Weekly - settlement is calculated every Monday.

- Monthly - settlement is calculated the first day of the month.

If there are no risk factors preventing it, you can change the settlement frequency yourself on

portal.vippsmobilepay.com.

See Online payments your sales unit

Settlement section

Edit.

Settlement flow

Settlements can occur at daily, weekly, or monthly intervals.

Settlement reports are available

within a few hours after the settlement (one file every day).

Payments are processed every day, but the banks may not book them until the next banking day. For example, the payout for Friday, Saturday, and Sunday arrive as three separate transactions and each payout has a separate settlement file.

There is only one payout per settlement period. Even if there have been thousands of payments in one week, there will still only be one payment (e.g., lump sum) from us to the merchant. The settlement reports have all the details for each of the thousands of payments. Additionally, there is one payment per sales unit and this includes a corresponding settlement file.

- Vipps

- MobilePay

The daily settlement flow for Vipps is as follows:

- Day 1:

- The payment is captured.

- At midnight: We calculate the settlement.

- Day 2: We make the settlement data available (See How to get settlement data).

- Day 3: We send the payment to the merchant's bank account. The bank may not book it until the next banking day.

For example:

- Monday capture results in a Wednesday payment 💰

- Friday capture results in a Tuesday payment 💰

Money is normally available in the account before noon.

The daily settlement flow for MobilePay with midnight cutoff:

- Day 1:

- The payment is captured.

- At midnight: We calculate the settlement.

- Day 2:

- We make the settlement data available (See How to get settlement data).

- We send the payment to the merchant's bank account. The bank may not book it until the next banking day.

For example:

- Monday capture results in a Tuesday payment 💰

- Friday capture results in a Monday payment 💰

How to get settlement data

You can get the settlement data in these ways:

The SFTP service was shut down on 2024-07-01. Please use the Report API to get data programmatically.

Get data through the Report API

Use the Report API to get your settlement data programmatically. With this API, you can get daily or continuous-feed settlement data for your accounts. See the Report API guide for details.

Download settlement reports

You can download reports from the portal at portal.vippsmobilepay.com in the Reports section.

Reports may include personal details of the customers. Please consider GDPR.

New beta version

We’re piloting a new format for downloadable settlement reports, now available in the portal as a beta. We encourage you to explore this option and share your feedback in the form provided in the portal. The more detailed your feedback, the better we can make the final version.

The new report format aims to be:

- Simpler

- More flexible, with customizable options

- A more complete and transparent reflection of account activity, especially helpful if unexpected events occur

- Better aligned with the Report API

- Uniform across all markets

- Faster to download, especially for large files

Good to know about the new reports:

- All account activity is now presented in a single chronological list. Unlike the old reports, where payouts and other events were separated into different tables, the new format displays everything together. This unified timeline can make it easier to trace the sequence of events - especially for troubleshooting or reconciliation. If you prefer to view only specific types of entries (such as payouts or refunds), you can easily filter or sort the data in your preferred spreadsheet software (e.g., Excel).

- The report includes all activity for the selected days, regardless of whether payouts have been scheduled on those days. For example, if today is included in the report period, you'll see today's transactions even if a payout hasn't been processed yet.

- A single report can cover multiple sales units, ordered first by sales unit and then chronologically by time.

- The report can be configured to include only payouts. This can be helpful (and much faster to generate) for sales units with high transaction volumes that are only interested in payouts.

You can currently download beta reports in both xlsx and csv formats, each containing the same data.

Example files

Columns

| Column name | Description |

|---|---|

| Sales unit | The name of the sales unit. |

| MSN/Vipps number | MSN for ePayments sales units; Vipps number for others (Norway only). |

| MSN/MobilePay number | MSN for ePayments sales units; MobilePay number for others (outside of Norway only). |

| Organization number | The organization's registration number (e.g. CCR, CVR etc.). |

| Country | The country that the sales unit operates in. |

| Payment solution | The payment solution used for the transaction, e.g. Epayment, Shopping basket. |

| Time | The timestamp for the entry (including time zone). |

| Booking date | The date the entry is booked on. |

| Type | Entry type, (see below). |

| Amount | Transaction amount. The sign of the amount indicates how it affects the balance. For instance, a Capture increases the balance, while a Payout scheduled decreases it. |

| Balance | The balance after the transaction, representing the running amount owed by Vipps MobilePay to the sales unit. It can be negative if the sales unit currently owes Vipps MobilePay money (e.g. after large refunds). The balance is typically reset to zero when a payout is scheduled. |

| Currency | The currency of the transaction. |

| Customer name | The full name of the customer. |

| Customer phone number | The masked phone number of the customer, including country code. (e.g. +47 xxxx 1234). |

| Message | The message attached to the transaction, if any. |

| Open Amount category | The transaction's category for Open amount payment solutions (when configured). |

| PSP reference | Vipps MobilePay's reference for the entry (equals reference in the Report API). |

| Order ID/Reference | Order ID for Vipps/MobilePay numbers; The merchant's own reference for ePayments (equals pspReference in the Report API). |

| Payout number | For Payout scheduled entries. |

Entry types

Each entry has one of the types described below. These correspond to the Funds entry types returned by the Report API. Additional types may be introduced in the future without prior notice; such updates will not be considered breaking changes.

| Type | Description |

|---|---|

| Capture | Payment from a customer to the merchant; increases the balance. |

| Refund | Refund from the merchant to a customer; decreases the balance. |

| Payout scheduled | Scheduled payout from Vipps MobilePay to the merchant; Typically we pay out the entire outstanding balance, which resets it to zero. |

| Fees retained | Amount retained by Vipps MobilePay to cover fees (includes capture and other fees); decreases the balance. Note: If you pay fees by invoice, they are not shown on this report. |

| Top up | Deposit by the merchant to Vipps MobilePay to cover a negative balance; increases the balance. |

| Credit note | Credit for a previously issued top-up invoice; decreases the balance. |

| Correction | Manual adjustment to the balance (may be positive or negative). |

Legacy version

This section concerns the old version of reports in the Norwegian market. They are available in several formats:

- XML

- CSV

- XLSX

PDF - Settlement report with key figures for the period you've selected.

For example:

XML - Key figures for accounting purposes.

Here are schemas and example files for XML settlement reports.

Both the current settlement report schema v3.0 and the old v2.0 version are available.

Example files are available for:

Changes to the settlement report XML schema from v2.0 to v3.0

NB! New settlements will contain a mix of captures and refunds. To make the numbers unambiguous we have introduced new fields for capture and refund, but kept gross and net fields as before.

-

Schema changes from v2.0 to v3.0:

- Old schema URL for v2.0 was SettlementReport-2.0.xsd

- New schema URL is SettlementReport-3.0.xsd

- New schema validates all amount fields with new types

money,positiveMoney, andnegativeMoney - Other changes organized by parent element below

-

Changes to PaymentsInfo:

ReportDateFromandReportDateTofields:- Drop time part, keep only date (in YYYY-MM-DD format)

- Change schema type from

xs:stringtoxs:date

- Remove control sums (

TotalSettledGrossAmount,TotalSettledNetAmount,TotalSettledFeeAmount, andTotalSettledRefundAmount) - Move

NumOfSettlementsafterSettlementInfoblocks to facilitate future streaming optimizations for large files

-

Changes to TransactionInfo:

- Rename

TransactionDatetoTransactionTimeand:- Change type from

xs:stringtoxs:dateTime - Fix time zone bug from previous report system where time UTC formatting was applied to Oslo time.

- Now always Oslo time zone, consistent with dates

- Change type from

- Change type of

TransactionIDfromxs:stringtoxs:long - Add field

TransactionCaptureAmount(always positive) - Add field

TransactionRefundAmount(always negative) - Note that

TransactionGrossAmount = TransactionCaptureAmount + TransactionRefundAmount

- Rename

-

Changes to

SettlementInfo:- Rename

SettlementBatchDatetoSettlementDateand:- Drop time part and change type from

xs:stringtoxs:date - For new settlements, this date is within the inclusive range

[ReportDateFrom, ReportDateTo]and is equal to or later than the date of the last transaction within the settlement - Note that the bank transfer will typically occur at a later date

- Drop time part and change type from

- Change type of

SettlementIDfromxs:stringtoxs:long - Move

NumOfTransactionsand all amounts to belowTransactionInfofields, to facilitate future streaming optimizations for large files - Add field

SettlementType(NetorGross) - Add field

SettledAmount, which is the amount paid out or invoiced (net or gross depending on settlement type) - Add field

CaptureSettlementAmount, sum ofTransactionCaptureAmountfields - Add field

RefundSettlementAmount, sum ofTransactionRefundAmountfields - Note that

GrossSettlementAmountis still the sum ofTransactionGrossAmountfields - Note that

GrossSettlementAmount = CaptureSettlementAmount + RefundSettlementAmount

- Rename

-

Changes to

FeeInfo:FeeInfowill only be included for old reports with gross settlement type- Change type of

FeeDatefromxs:stringtoxs:date - Change type of

FeeAccountfromxs:longtoxs:string

-

Changes to

SettlementDetailsInfo:- Change type of

MainAddressCityfromxs:NCNametoxs:string

- Change type of

-

Changes to

VippsInfo:- Change type of

WebSitefromxs:NCNametoxs:anyURI - Change type of

Countryfromxs:NCNametoxs:string

- Change type of

CSV - Key figures for accounting purposes.

For example:

CSV settlement file contents:

The CSV settlement file contains the following info:

| Column title | Description | Comment |

|---|---|---|

| Salgsdato | Date of sale | |

| Salgssted | Sales unit name | |

| Vippsnummer | Merchant serial number | |

| Produkt | Vipps product name | E.G. "Vipps Netthandel" |

| Transaksjons-ID | Transaction ID | Differs for Reserved, Captured and Refunded transaction |

| Ordre-ID | Ordre ID | |

| Brutto | Total amount | |

| Gebyr | Fees | |

| Netto | Total amount minus fees | |

| Transaksjonstype | Transaction type | E.G. Salg (Sale), Refundering (Refund) |

| Oppgjørs-ID | Settlement ID | |

| Oppgjørsdato | Settlement date | |

| Oppgjørssum | Settlement total amount | |

| Oppgjørskonto | Settlement bank account number | |

| Fornavn | First name | Only applicable for Vippsnummer |

| Etternavn | Last name | Only applicable for Vippsnummer |

| Melding | Message/Transaction text |

XLSX - Transaction overview (Excel) containing all transactions, including those that aren't settled yet.

For example:

Settlement report availability

Settlement reports are available within a few hours after the settlement.

Daily settlement reports are created every day (one file every day), as long as the balance is positive (see Download reports from the business portal).

If the balance for a day is zero (e.g. due to lack of transaction) or negative (e.g. due to refunds), a settlement will not be created until the balance becomes positive. This means that in some cases, a settlement report may include transactions spanning several days back in time.

Settlement reports are available by 12:00 noon. The reports are generated around 01:00-03:00 at night, but may be delayed due to technical changes, maintenance in various systems, or other unforeseen events.

There will be no settlement reports for dates without completed payments. In these cases, neither the settlement files nor the directories that should have contained settlement files will exist.

If a merchant has refunded more money than the sum of payments, so that the balance is negative, we will not create settlement reports. We cover the negative balance for a short while, but if it persists, we will send an invoice to the merchant to settle the balance.

There are no settlement reports for the test environment.

For help finding the reports, see How to get settlement data.

Net and gross settlements

There are two types of settlements:

- Net settlement: Merchants will receive the users' payments excluding the Vipps MobilePay fees. In other words: The Vipps MobilePay fees are deducted from the settlement amount.

- Gross settlement: Merchants receive the full amount of the users' payments including the Vipps MobilePay fees. The merchant is then invoiced for the fees.

Net settlement is the default and is, in practice, the only settlement method offered. Gross settlements are only offered in very rare cases. With gross settlements, Vipps MobilePay essentially provides a loan to the merchant, and this involves both additional cost and risk and also requires additional checks.

For gross settlements, if the merchant's organization number is registered as an EHF recipient, Vipps MobilePay sends invoices as EHF. If not, the invoices are sent by email. To change the invoice recipient, please contact customer service.

See Settlement report availability for information about settlement files when the balance is negative.

Identifying payments

If you need to use the payment's ID to identify a payment, then use an online solution, such as the ePayment API.

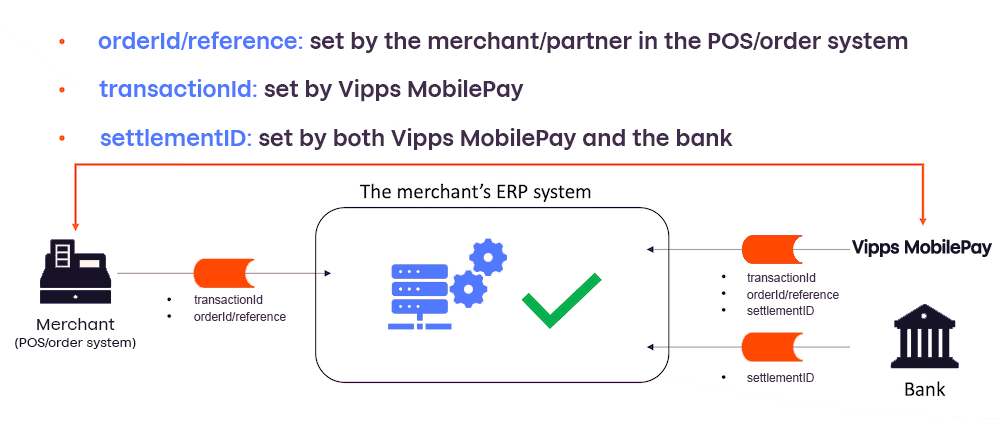

A simple illustration showing where each ID is set, and how it all fits together.

Additional info for recurring payments

For recurring payments, the orderID is an optional field.

If orderID is not specified by the merchant when making a charge,

the settlement report shows the automatically generated chargeID in the orderID field.

If orderID is in use, this is also used in the settlement report.

See the Recurring API for more details.

GDPR

We need the customer's consent before sharing personal information.

Settlement reports generally don't contain personal information; however, payments made with Vippsnummer and MobilePay-nummer may have personal information and must be treated with care.

See the FAQ: Why are the customer names not shown on the transaction overview?