Technical update Mar 2025

New to the technical updates?

Technical updates are sent 3–6 times a year and contain information about changes and updates to APIs, new product features, and other important information to ensure that your solutions run smoothly. See: API lifecycle.

We send technical updates to all merchants with access to an API, and to all partners. See Technical updates for more details.

ePayment API: Express payments in all markets

EDITED on May 6: Launch is delayed and is now expected in Q2 2025. We will provide further updates as soon as possible.

We will soon launch

Express

in April, enabling merchants in Norway, Denmark and Finland to offer

very, very easy payments with the Vipps and MobilePay app:

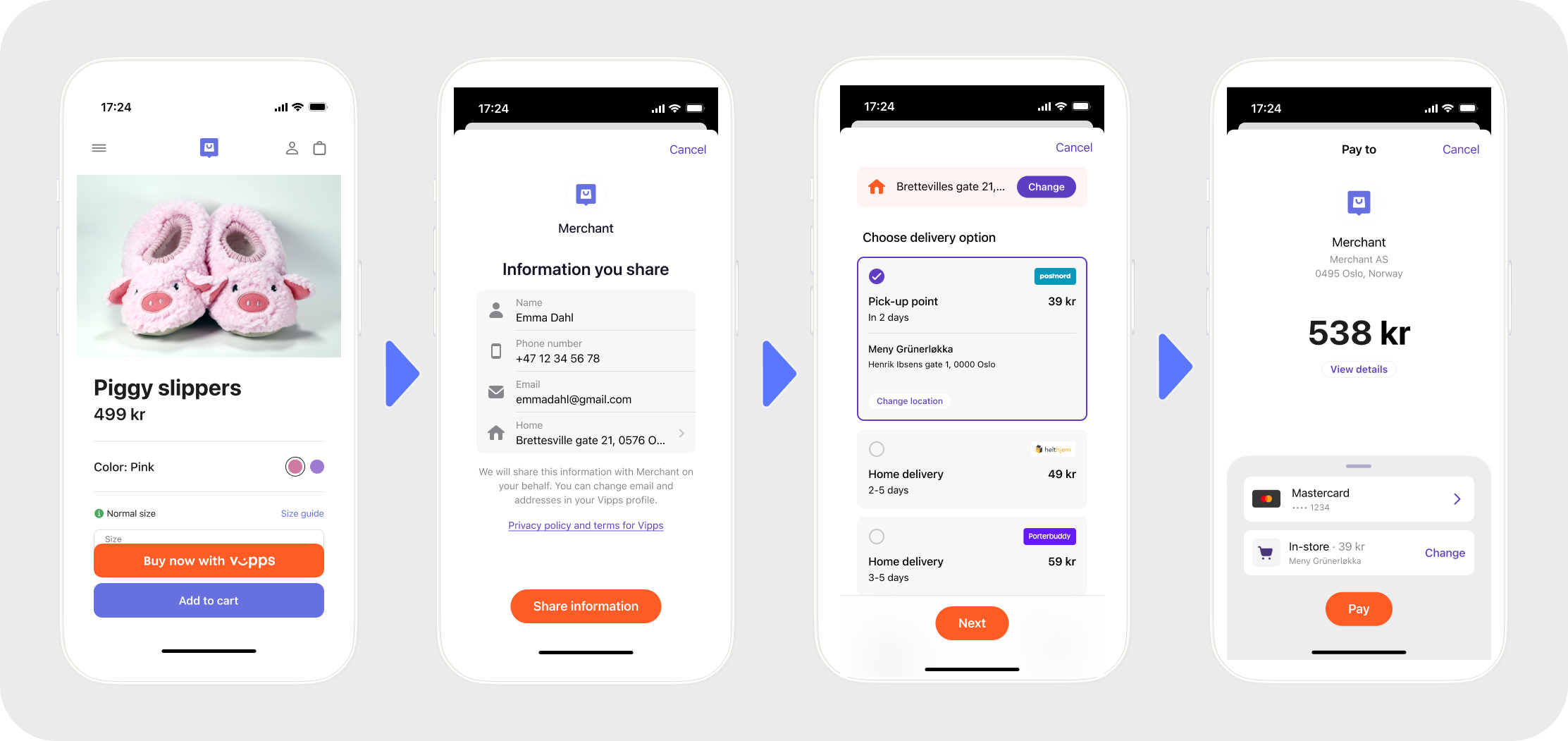

- The user selects to pay with Vipps/MobilePay in the merchant's website or app, and the Vipps/MobilePay app opens.

- The user consents to share their address and personal information with the merchant.

- The merchant displays the available shipping options within the Vipps/MobilePay app.

- The user selects the preferred shipping option and approves the payment the Vipps/MobilePay app.

Benefits:

- For users: We eliminate all the form-filling normally required: Username, password, name, address, shipping method, etc.

- For merchants: We provide verified data about the user, and eliminate all the friction that normally causes drop-offs.

Express is new functionality in the ePayment API.

Express can be used on both product pages (to let users buy with "1 click") and on the shopping cart page (simplifying the last step of the checkout process).

Automatic update of cards

Starting in April we will automatically update cards that have been added to the app: If a user has added a card to the Vipps/MobilePay app, we will automatically update it before the expiry date.

This applies for both Visa and MasterCard, using their respective token-based services.

This will improve the conversion rates for both the Recurring API and the ePayment API.

This functionality will first be available in Norway, and then in Denmark and Finland.

MobilePay APIs: The facade APIs will be shut down on June 30

An important reminder of the information provided for about one year:

- Until 30 April 2025: Priority migration support

- 01 May 2025: Priority migration support ends

- 31 May 2025: Latest recommended go-live date

- 30 June 2025: End of facade general availability

Brand guidelines and button generator

The Vipps and MobilePay brands are extremely strong. To ensure the best possible user experience and the highest possible success rate, it's important to follow our brand guidelines.

See our button generator.

Don't misuse the Vipps or MobilePay brand in checkout to initiate any action other than a flow controlled by Vipps MobilePay (either open our app or a Vipps/MobilePay landing page).

Recurring API: Letting users stop payment agreements in the Vipps MobilePay app

In the 2025-02 Technical Update we informed about Customer support cases for stopping payment agreements.

We want to clarify:

- All agreements must have a valid agreement URL, so users can easily access the merchant's website and manage the agreement. We strongly recommend using Vipps MobilePay Login for users accessing the agreement URL. If the agreement URL changes you must update the agreement.

- Users can stop payment agreements directly in our app: Stopping an agreement in the Vipps MobilePay app.

- KAM merchants (merchants with a Key Account Manager) can "opt out" of this: Opting out of the Stop Payment Agreement feature.

In extreme cases, where many users contact our customer service because they can't get help from the merchant to cancel their payment agreement, we may enable the "stop agreement" in our app. We may also do the same when an agreement has an agreement URL that does not take the user directly to the page where the agreement can be managed.

Reminder: Logos for sales units

Please ensure that your sales unit has a logo that users see in the Vipps/MobilePay app and on the landing page. Sales units without logos can make users uncertain if they're paying to the right sales unit, cause them to abort the payment, resulting in a lower completion rate.

Partners can provide logos for new sales units using the Management API's prefill functionality, merchants can manage their sales unit logos on the business portal, and PSPs can use the PSP Signup API.

Report API: Real-time data

The Report API now offers near real-time data. See the FAQ: Can I get real-time data?.

Partner portal

The partner portal is for all partners, and also for large merchants who manage multiple legal entities. See: How to request access

We have added functionality for viewing registered webhooks, and will soon also show information about webhooks that fail on the merchant side.

Other functionality on the partner portal:

- Check the status of all product orders

- Get the details for one merchant

- Get a list of all sales units

- Get a list of all sales units for one merchant

- Get details for a sales unit

- Get a list of price packages

ePayment API: reference can now be 64 characters

We have bumped the maximum

reference

length from 50 to 64 characters.