Technical update November 2025

Recurring Payments

This section shows new features in the Recurring Payments product and the Recurring API.

One day lead time for recurring charges

Merchants and partners can now create a new charge one day before the charge due date, instead of two days. See: Recurring API guide - Due date.

Deep links are not recommended

Deep links that use custom URL schemes (e.g., vipps://) for direct app-to-app switching are not recommended.

For a smoother and more reliable user experience in the payment agreement signup flow, always use universal links.

See: App flow recommendations.

Age verification for payment agreements

Starting 2025-12-09, the Recurring API will enforce this age requirement by rejecting agreement creations for users under 18. This adds an extra layer of protection, while age verification remains the responsibility of the merchant.

For more details, see our guidelines for under-18 user flows.

Improved user experience for existing payment agreements

We’re introducing an improved user experience in the app for how existing payment agreements are displayed. The new design will be launched in early November. For a preview, see Existing payment agreements section in the documentation.

Demo updated

The Recurring demo "store" is updated, and you can now try out campaigns, profile sharing and lots of other functionality,

and see exactly what it looks like on our app:

demo.vipps.no: Recurring.

Portal

This section shows new features in the portal.vippsmobilepay.com, business portal and partner portal.

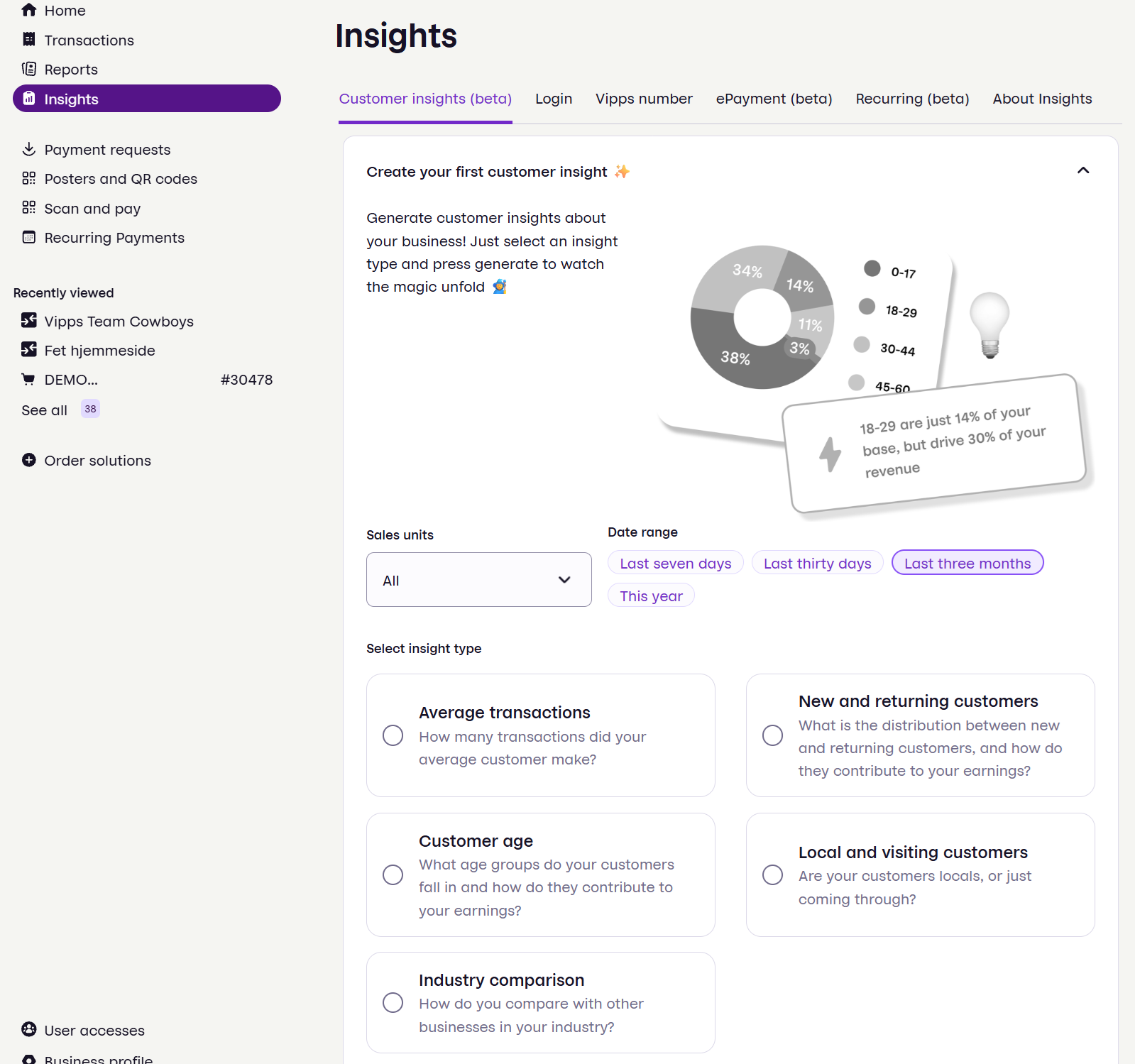

Payment Insights

A new feature, Payment Insights, is now available on portal.vippsmobilepay.com for both partners and merchants. Payment Insights gives access to key business metrics, such as transaction volume, success rate, and conversion rates.

With Payment Insights, it's easy to assess the quality of your Vipps MobilePay integration, and you can quickly identify whether your setup meets best practice standards, spot sales units that are performing exceptionally well or underperforming, and detect any shifts in performance that may require attention.

Single Sign-On (SSO) for business portal

The business portal, portal.vippsmobilepay.com, now supports single sign-on (SSO), making it easier for businesses to manage portal access using their existing authentication systems.

Supported identity providers:

- Microsoft Entra ID (formerly Azure AD) with OIDC

- Okta with OIDC

For more details, see: About the business portal: SSO documentation.

Webhooks and error monitoring

Merchants and partners can now view their registered webhooks in portal.vippsmobilepay.com, as well as any errors encountered during webhook delivery attempts.

Merchants can:

Partners can:

See: Webhooks API.

When webhooks fail, it often leads to failed payment processes, causing users to perceive that "Vipps MobilePay doesn't work".

Tip: If you don't receive the expected webhook, always poll the API to ensure accurate payment status. See Polling guidelines.